Unlocking the Power of Candlestick Patterns in Forex Trading

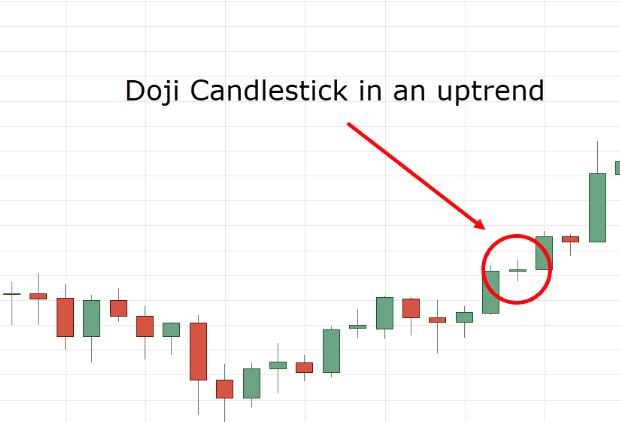

In the world of forex trading, understanding candlestick patterns is crucial for making savvy decisions and honing trading strategies. These patterns offer valuable insights into how the market feels and where prices might be headed. In this detailed guide, we’ll explore the top five candlestick patterns that can help traders level up their game and […]

Unlocking the Power of Candlestick Patterns in Forex Trading Read More »