Doji Candles are candlestick patterns used to analyze trend reversals on the market. To place successful forex trades, traders can examine past price movements using the Doji candlestick to forecast future prices. You can use Doji Candlestick patterns to confirm a potential high or low price point by comparing a currency pair’s open and close prices.

Here’s how you can use it to place more successful trades.

Doji Candlesticks: How to trade them?

1. Create an account with a forex broker

Open an account with a forex broker before trading with the Doji Candlestick pattern. To trade on the forex market, look for brokers with the right certifications and a wide range of tools. To open an account, provide the broker with the necessary documents once you find a platform that suits your needs.

2. Choose the FX pair you want to trade

Once you have opened a forex account, you should research the currency pairs trading in the market and their historical price movements. Suggest a pair or pair based on their past performance and potential future direction.

3. Monitor FX pair prices with a Doji Candlestick pattern

Once you decide which currency pair(s) to trade, use one of the best candlestick patterns, the Doji, to track the current market price. You can decide your next trading step based on whether you receive long or short signals from Doji Candlesticks.

4. Enter with a Doji Candlestick

If the Doji Candle is almost the same price on both the closing and opening of the market, it indicates that a possible bullish reversal has occurred. Once the price signal is confirmed, you can buy the currency pair and trade for a long position.

5. Exit with a Doji Candlestick

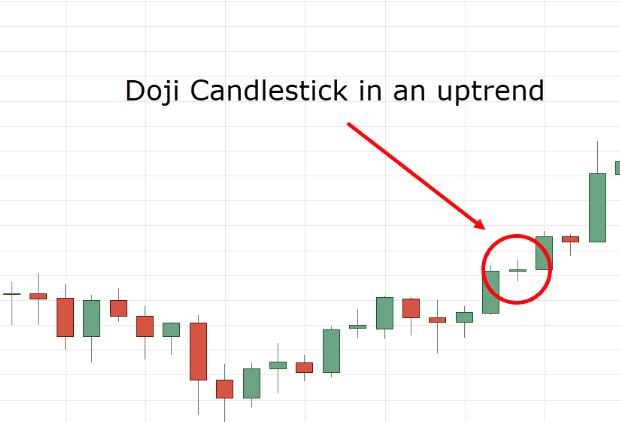

It indicates that a bearish reversal may be imminent when the Doji Candlestick is at the top of an uptrend after staying in the position for some time. You can exit the market by selling your currency pairs when you confirm the price signal. This will minimize your possible losses by trading for a short position.

What does a Doji tell traders?

In technical analysis, a Doji Candlestick indicates that a reversal is about to occur—an opening and closing price of a currency pair and the following low and high prices. In trading, a bearish Doji indicates a reversal in a downtrend, and a bullish Doji indicates a reversal in an uptrend.

Why is a Doji different from a spinning top?

Doji and Spinning Top are reversal signals indicating the current market direction is changing. However, Doji Candlesticks are smaller than Spinning Top Candlesticks with smaller lower and upper wicks. On the other hand, the Spinning Top Candlesticks have larger bodies with longer wicks and upper and lower wicks.

Bottom line

A Doji Candlestick is more appropriate for currency pairs with closing and opening prices close to one another; Doji Candlesticks are more appropriate. Doji Candlesticks also have small wicks because there is not a huge difference between the high and low prices of the currency pair at the moment. In addition to forming a plus sign, dojis also appear as spinning tops.