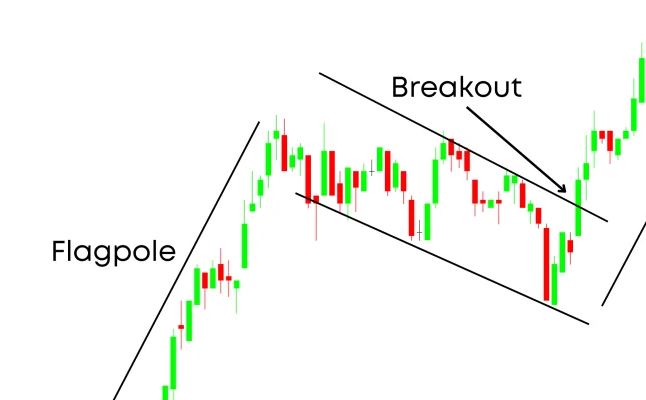

Having the ability to read charts is a well-crafted skill that requires relentless practice and constant adjustments to become a consistently successful trader. Learning never stops, and perfection is never guaranteed. Learning to recognize trading patterns is essential to building an effective portfolio. Recognizing patterns as they emerge and form is a powerful tool for conquering an otherwise unpredictable market. Training your brain to recognize patterns and act on them quickly is essential.

Being Fast vs. Being Good

Trading pattern recognition means you’re able to identify a pattern. What you do next is still up to you. We don’t instinctively know what to do.

To know which charts are good and which are wrong, you must distinguish between the two. Reading charts fluently is pointless if you cannot distinguish between quality charts and garbage ones.

However, this does not mean you should spend much time finding one pattern. Spending too much time on one pattern could mean you miss out on opportunities. Finding the sweet spot means spending enough time on recognition and action but not too much that you miss out on opportunities.

Persistent and Consistent Analysis

Don’t let unaccounted variations in your analysis happen by keeping your workflow and variables consistent. A chart’s reliability and consistency can be greatly affected by changes in screen resolution, zoom level, chart width, indicator space, and chart software.

It is possible to have problems reading charts fluently because of the following factors:

Chart Orientation

It may seem silly, but how charts are arranged can significantly impact how they’re read. For example, traders viewing several charts vertically or horizontally cannot see the whole picture.

The display is distorted for vertical viewers because the price is scaled to fit the available space.

With the split, the trend will appear smaller, while the ranges will be magnified for horizontal viewers.

You can see everything you need on one screen using chart profiles, watchlists, trading plans, and alerts. With disciplined organization, you can keep track of everything you need on one screen.

Choosing the Right Platform

Those who have tried multiple platforms will be familiar with this one. Charts can differ significantly from one service to another. Find charting and trading platforms that suit you to recognize trading patterns accurately. It is unnecessary to compare the charting platform with the trading platform if the chart shows a sign. There may be differences, and you might miss out on the trade due to hesitation. You can make the trade if it looks good on your charting platform.

Seeing Different Signals

What we know about the world is constructed based on what we agree means specific colors. For example, we all agree that red signifies stopping, while green signifies moving ahead.

You should be conscious of how you construct your chart to avoid our preconceived feelings toward specific colors. If you feel a particular color invokes strong feelings that have nothing to do with trading or your analysis, you should avoid it.

Making you lose your reading ability when switching between bar charts and candlesticks is also a bad idea. Make sure you never confuse yourself by altering how you arrange your charts.

Bottom line

In our view, trading pattern recognition is a skill that evolves with practice, similar to learning a new language. In addition to offering practical tips for skill development, traders should balance speed with quality, keep their analysis consistent, and avoid distractions like color biases.