As a trader, price action is the most common term that you hear on daily basis. However, price action comes with several patterns and hundred of strategies. You can’t master all but let’s get acquainted with one of the most famous strategies. You must have heard of the Wolfe wave price action strategy. In this article, we will dive into the details of this strategy.

What are Wolfe Waves?

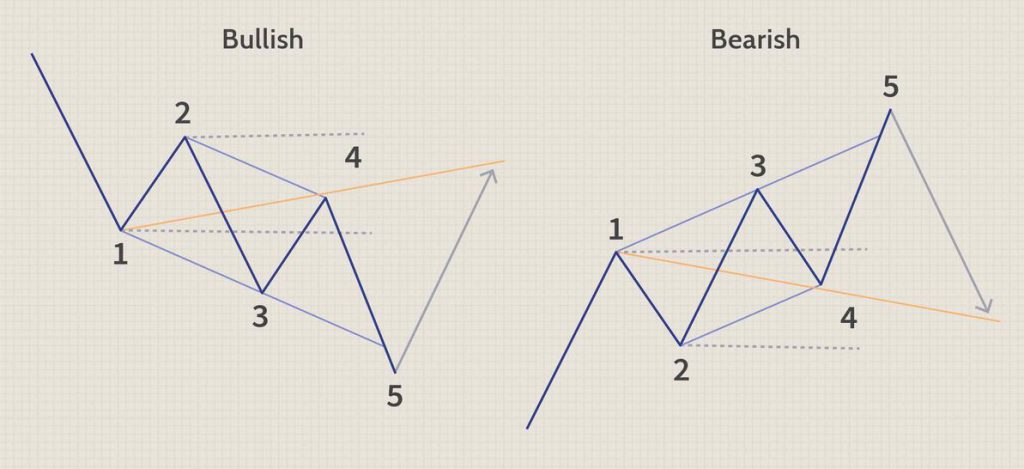

They are one of the many wave theories. Wolfe Waves are a reversal pattern that obeys very strict rules. They are a pattern of five waves that indicate either bullish or bearish trends.

The Wolfe wave trading strategy is based on Newton’s third law of motion, stating, “Every action has an equal and opposite reaction.” The price swings like a pendulum, up and down.

Bullish Wolfe Pattern

Point 1 is the first of three model points.

Point 2 is the first vertex of the vibrational price movement and should be above point 1.

Point 3 is the second of three model definition points and should be located on the chart below point 1.

Point 4 is the high of the second wave of our pattern. It should be located below the second and above the third point.

Point 5 is the third point in the model definition. This is our entry point. The pattern is considered acceptable for the trade started after reaching this point.

Points 1-3-5 – are located on the same line.

Point 6 is our profit target. It is located on the line drawn from point 1 to point 4. All positions are closed, and the pattern is considered mature after reaching point 6.

Points 1-4-6 are located on the same line.

Bearish Wolfe Pattern

Point 1 is the first of three model definition points.

Point 2 is the first vertex of the vibrational price movement and should be located below point 1.

Point 3 is the second of three points of model definition. It is the high achieved after wave 1-2. It should be located on the chart above point 1.

Point 4 is the minimum of the second wave of our pattern and should be located below the second and the third point.

Point 5 is the third point in the model definition. It should be located above the third point. This is our entry point. The pattern is considered acceptable for the trade started after reaching this point.

Points 1-3-5 – are located on the same line.

Point 6 is our goal. It is located on the line drawn from point 1 to point 4. Therefore, all positions are closed, and the pattern is considered to be spent after reaching point 6.

Points 1-4-6 are located on the same line.

Bottom line

Despite being tough, the Wolfe pattern is a highly effective tool for conducting analysis of waves. The results will be beyond your expectations.