The concept of leverage in trading is taking advantage of artificially boosted transaction sizes to make more money from every trade. What if you were buying shares intending to become a professional share dealer? It will take you some time to generate a full-time income without enormous starting capital. If you do not have more than six capital figures at your disposal, you may not participate.

However, leverage compensates for the difference in individual trades, allowing traders to take profits more quickly. The risk associated with leverage in any transaction increases dramatically when generating substantial gains, and the complications leverage can present when it starts working against you are significant.

How does leverage work?

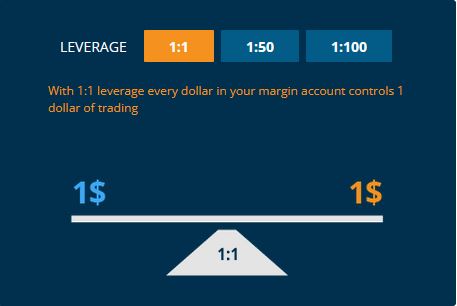

Leverage allows you to increase your exposure to an underlying asset by leveraging a deposit, known as margin.

By putting a fraction down, you borrow the rest from your provider. While you only pay a small percentage of the whole trade’s value upfront, the amount of your profit or loss is based upon the total size of the trade, not the margin amount. Your leverage ratio tells you how much you’re exposed to your margin.

Advantages of leverage in Forex

Are there any specific benefits to leverage, and how does it make sense for forex traders? Let’s find out.

Increase Profit

Trading with leverage has the first and most important benefit of earning more money for less work. Leverage is a financial tool that maximises your profit from each transaction by multiplying the stakes, regardless of your trading instrument or how much you’re staking.

Increase capital efficiency

Furthermore, increasing the amount of money you can earn per transaction increases the efficiency of the way your capital is used. So let’s get a bit more technical here; think of your capital to deliver a return. Simply speaking, leverage has an enormous impact on capital efficiency, resulting in greater profits in the short term and a more substantial return on investment over a much shorter period.

Mitigate against low volatility

Leverage can also mitigate forex trading volatility, which is another crucial advantage. Because volatile markets move in broader cycles than more stable ones, volatile trades often deliver tremendous profits. Moreover, since forex markets are deregulated, and the parties dealing in currency are cautious, few external factors can affect the exchange rate, and volatility tends towards the lower end.

Risks of leverage

Leverage can effectively earn significant profits for investors, but it can also work against them.

As an example, leverage can significantly increase your potential losses if the currency you are trading moves in the opposite direction than what you expected. Therefore, a forex trader’s trading style is strictly controlled by stop-loss orders to control potential losses.

Bottom line

Leverage has several disadvantages, but it should not deter traders from using it or trading leverage. On the contrary, leverage is generally considered a good thing, and in foreign exchange markets, where it compensates for lack of volatility, it is crucial to allow quick returns.