Managing your capital is one of the most important skills in the forex market.

To get the full return on your invested funds, you need to manage your capital with moderate risks.

How to do it? There is no clear answer, but there are many different methods that can help you.

One of the most talked-about is the Martingale. Martingale method is a financial money management strategy that gained popularity back in the 18th century.

Invented by Paul Levy (French Mathematician), the Martingale strategy was a type of betting. The essence of the strategy was to constantly double the bet when losing so that later one winning trade could cover all the unprofitable ones.

To give you an idea of how this strategy works, here’s an example.

A roulette player bets $1 on the red. He loses, bets $2 again and loses again. Next, he bets $4, and this time wins $8. His profit is $1. You may be wondering how?

His total risked amount is $1+2+4=7. He wins $8. So, 8-7= $1. So, that’s how he gets his profit.

Martingale in Forex

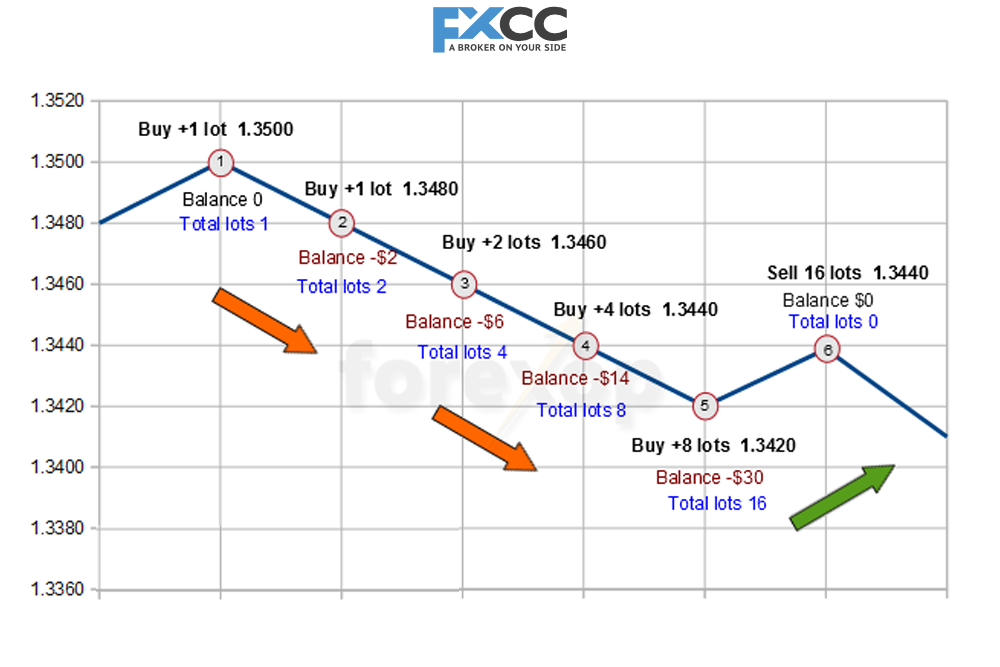

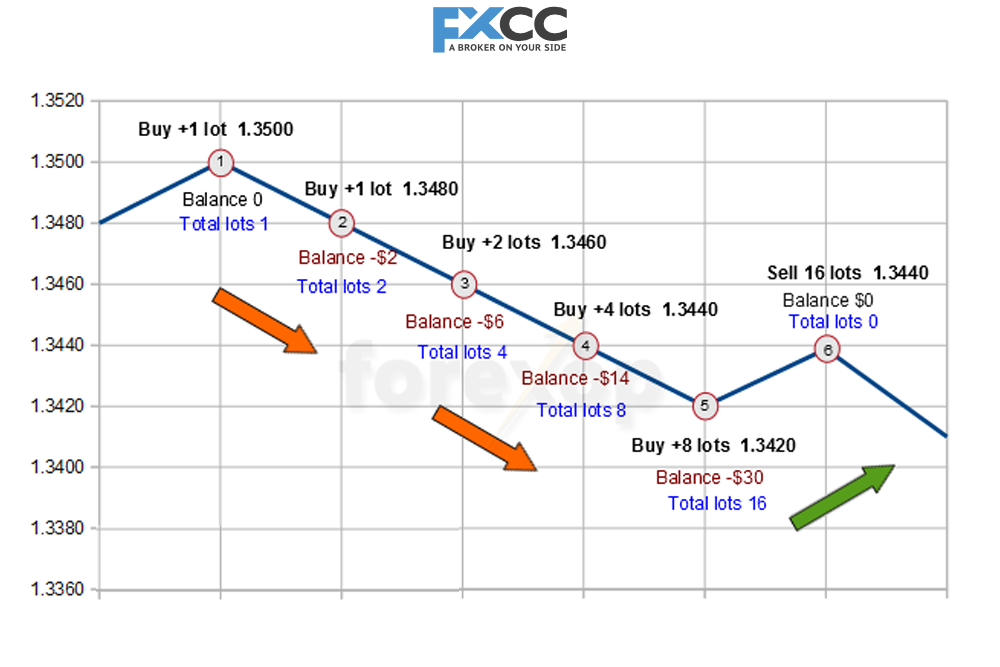

In forex, Martingale requires increasing the size of the forex lot after each loss and reducing the size after profitable positions.

Let’s break down the strategy by giving you an example.

You bought the EUR/USD at 1.1237. To get profit, you have to make above 1.1237. The more you lose, the more lots you add until you reach 1.1237. If the trend is in your favor, you can quickly get profit from it.

The martingale strategy has an advantage in forex. The currency pairs rarely go down to zero. Even in the case of market uncertainty, currency pairs don’t drop to zero. With Martingale, you will have the chance to benefit from what you have lost.

Besides this, if you have significant deposited capital, Martingale can work in your favor. You can earn a great deal from interest. This means that traders can buy a currency pair with a low-interest rate and sell it for a higher interest rate.

But the problem is if the price goes down by 1.1137 (from the above example), you lose 100 pips. This way, you can go bankrupt if your account balance is low.

The Martingale method is not fun and games. You need to have a large amount at your disposal to win what you have lost.

The Martingale strategy works perfectly in forex if the markets are mean-reverting. Mean reversion is a phenomenon in financial markets that suggests the asset price will eventually come to its average price.

The forex market can continue in the same direction for an extended period, and that’s where Martingale fails.

Conclusion

No matter how effective and profitable Martingale’s forex strategy is at first glance, it is essential to remember that one wrong step can lead your account to zero even before the moment when the profit covers all your losses. That is why, before applying this strategy in trading, learn to calculate each move.

New to Forex trading? Don’t miss these beginner guides from FXCC.

– Learn Forex Trading step by step

– How to read Forex charts

– What is spread in Forex Trading?

– What is a Pip in Forex?

– Low Spread Forex Broker

– What is Forex Leverage

– Forex Deposit Methods