There are many reasons why investors invest in the stock market. Investing long-term can build wealth over time, while trading for an immediate profit can be profitable – and many individuals pursue both.

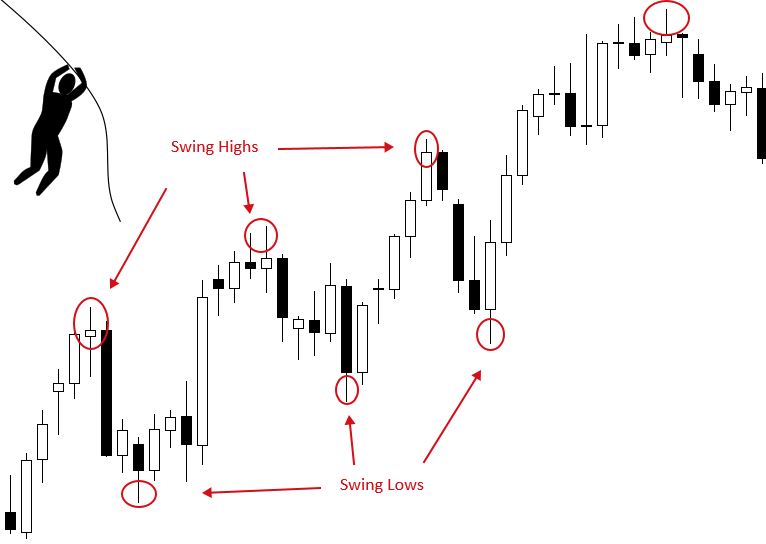

Among the many strategies for trading, swing trading is one of the easiest for newcomers to learn. Swing trading is slow compared to day trading, which moves extremely fast. An excellent way to get a taste of technical analysis is by using this strategy. The following information should be helpful.

What Is Swing trading?

Attempting to profit from the financial markets can be challenging, as there are many different ways to do so. Besides the wide selection of available trading strategies, various trading styles are also available. The time frame you trade is one of the main variations in trading styles.

Further, with long-term trading rarely needing much more than a bit of attention each day, long-term trading often won’t need much attention. However, you will have to be more patient, and trading opportunities will be less frequent.

Scalpers represent the opposite extreme. Rather than making long-term investments, scalpers make frequent short-term trades that last for only a few minutes to profit from each trade.

Due to their concise length, these trades have an advantage – that you reduce the amount of exposure to the market. Additionally, you have many trading opportunities since you are only observing minimal price movements.

Top tips for forex swing trading

Here are our top tips on how to succeed as a swing trader now that you know the basics of swing trading.

Align your trades with the long-term trend

It may also be helpful to view a longer-term chart (D1 or W1), even if you look at a shorter-term chart (e.g., H1 or H4). If you trade against a more significant trend, you can ensure you aren’t making a mistake. Trading with the trend makes swing trading easier than against it.

Make the most of Moving Averages (MAs)

You can determine the trend using the MA indicator by smoothing short-term price fluctuations.

Use a little leverage

Gaining access to a more prominent position means you can potentially earn (and lose) more than you usually would with your deposit. By utilizing leverage wisely, you can make the most of profitable trades. However, it would be best if you were careful with it.

Trade a wide portfolio of forex pairs

You can find the best opportunities by monitoring as many currency pairs as possible. There will always be trading opportunities on the Forex market. However, you must pick those that are most appropriate for your style, strategies, and risk tolerance.

It is a good idea to trade multiple pairs to diversify your portfolio and avoid the risk of keeping all your eggs in one basket.

Pay attention to swaps

A swap is an overnight interest charge made on a position. To better manage your money, you need to consider the cost of these swaps.

Put aside your emotions

Forex trading is better to follow your swing trading strategy in conjunction with a well-established plan rather than trading with emotion.

Bottom line

New traders typically start swing trading with $5k-$10k, although less is acceptable. With swing trading, getting their feet wet in the market is easy. The investor must make sure their capital is money they can afford to lose. Risk management is essential, but the unexpected can still occur. A swing trader can also start slowly and build the number of trades over time because swing trading doesn’t require the same active attention as day trading. However, it requires investors to get into the nitty-gritty of technical analysis, so a knack for charts and numbers is necessary.