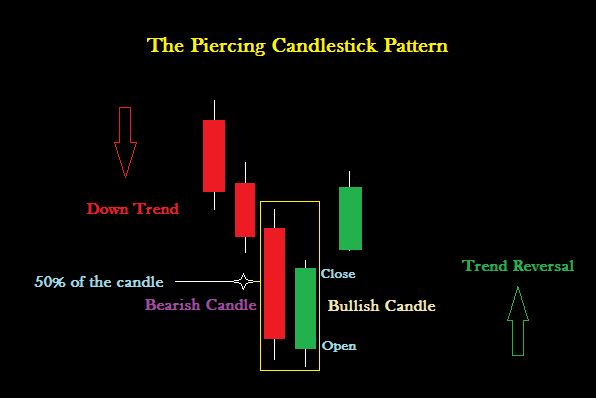

The piercing pattern consists of two candlesticks. It indicates a reversal from the bearish to a bullish pattern and appears in a downtrend.

What is the Piercing Candlestick Pattern?

The bullish second candle follows the bearish first candle of the Piercing Pattern. The bearish candle starts high and ends around the bullish candle’s bottom.

The bullish candle closes above the bearish candle’s midpoint.

The Piercing Pattern indicates that the bears previously controlled the trend but that the tendency has now shifted to bulls, indicating that the price is rising upwards.

To confirm the emergence of the Piercing Pattern, traders look at the following candle after the bullish candle.

It’s important to remember that piercing is a temporary trend. As a result, the Piercing Pattern can only predict trend reversals for a limited time.

How to identify the pattern?

The Piercing Pattern can only show five bullish candles once it develops.

Traders will notice a breakout gap while looking at the pattern. It denotes two bullish candlesticks in a row.

The difference between the closing price of the first candle and the opening price of the second candle is greater than the second candle. It is considered a powerful trend reversal when the Piercing Pattern occurs before the breakaway gap.

The pattern can be found on daily and weekly charts by traders. The Piercing Pattern, on the other hand, may take many weeks to appear.

How to apply the Piercing candlestick strategy?

Piercing is a bullish reversal pattern that might produce buy signals. Buyers might enter a trade at the confirmation candle after spotting the pattern.

A traditional trader would wait for the trend to continue before entering after the confirmation candle. The Piercing Pattern’s latest low serves as a stop-loss.

Furthermore, traders who had previously held short positions leave the transaction shortly before forming the Piercing Pattern.

The Piercing Pattern indicates short-term reversals, as previously stated. Profit targets are not something it can inform you about. Traders utilize the Piercing Pattern in combination with other indicators to locate profit targets.

When entering trading positions, traders should keep a few things in mind: first, the trend should be down since the piercing pattern is a bullish reversal pattern.

Second, the length of the candlestick is crucial in predicting the strength with which the reversal will occur.

The size of the gap between the bearish and bullish candlesticks reflects the strength of the trend reversal.

Fourth, the bullish candlestick should close higher than the preceding bearish candlestick’s midpoint.

Finally, both the bearish and bullish candlestick bodies should be bigger.

The Piercing Pattern, if found, is a good sign of a trend reversal. However, relying on the pattern alone is not a good idea.

Longer periods are ideal for the Piercing Pattern. As a result, using the pattern on trending or range markets is a good strategy.

Bottom line

The Piercing Pattern is a short-term trend reversal. The pattern becomes valuable if it appears after the long downtrend or a gap between the two candles following it. However, it is advisable to confirm exit and entry signals to apply the Piercing pattern with momentum oscillators.