Remember April 6, 2012 is a holiday and most markets are closed. The US will release the Non Farms Payroll report on Friday. Many markets are closed on Monday also. Trading volume will be light today and on Monday.

Euro Dollar

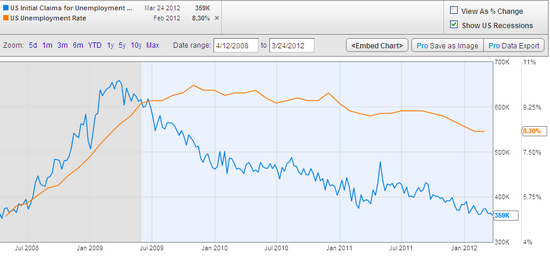

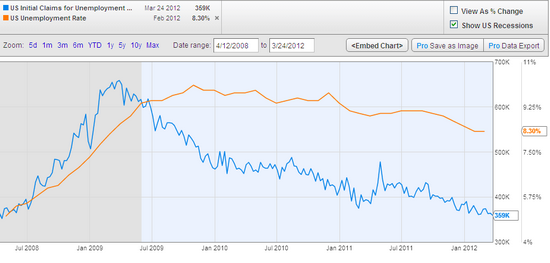

USD- U.S. Non-Farm Payrolls and Employment Situation, the main indicator of U.S. economic health measuring job creation and unemployment, Fri., Apr. 6, 8:30 am, ET. Even though job creation is forecast to not be as strong as it was in the previous month, the positive trend in the U.S. labor market would be likely to continue with the economy adding another 200K jobs in March, compared with 227K in February, while the unemployment rate stays at the current 8.3% level.

As long as the U.S. job market continues to demonstrate consistent improvement, the USD should benefit from reduced QE3 odds.

The euro continues to fall against the USD trading at 1.3060 at this time. EUR/USD dropped to 1.3034 during U.S. morning trade, the pair’s lowest since March 16; the pair subsequently consolidated at 1.3060, later in the session, giving back 0.62%.

The euro continues to fall against the USD trading at 1.3060 at this time. EUR/USD dropped to 1.3034 during U.S. morning trade, the pair’s lowest since March 16; the pair subsequently consolidated at 1.3060, later in the session, giving back 0.62%.

The number of Americans who filed requests for jobless benefits fell by 6,000 last week to 357,000, the U.S. Labor Department said Thursday. Economists had projected claims would total 360,000, The French government sold 8.439 billion euros ($11.1 billion) of various government bonds Thursday, near the top end of its range of 7 billion to 8.5 billion euros, but saw borrowing costs rise. France’s debt agency said it sold 1.31 billion.

Spanish and Italian bond yields continued to rise on Thursday, as the broader European equity market declined. Yields on 10-year Spanish government bonds added 5 basis to 5.71%, the highest level since December last year. Spanish 10-year yield rose 8 basis points and rise to the highest level since December on Thursday, as the effects from the European Central Bank’s cheap lending program start to wear off.

Markets are closed today

The Sterling Pound

Sterling is down against the USD currently valued at 1.5822.

The Bank of England, as widely expected, left its key lending rate unchanged and made no alterations to its 325 billion pound ($516.8) program of asset purchases. The central bank’s key lending rate has stood at a record low 0.5% since March 2009. Office for National Statistics said manufacturing production fell by 1% in February, slipping below analysts’ expectations of a 0.1% increase.

The Society of Motor Manufacturers and Traders, or SMMT, said Thursday the March new car market beat expectations with a 1.8% rise to 372,835 units, making a a rise of 0.9% over the first quarter The UK’s economy is a mixed bag, some reports are up and some are down. Many have continued to question austerity measures in the UK. Employment and housing markets remain depressed. PMI surprised the markets along with current accounts.

Markets are closed today

The Swiss Franc

The euro traded at 1.2017 Swiss francs in recent action on Thursday, a loss of 0.1% on the day, after earlier falling below the CHF1.20 floor set by the Swiss National Bank last year. The SNB has previously said it would defend the floor with “utmost determination”, indicating it was prepared to intervene in forex markets to cap the strength of the Swiss franc.

The euro was under pressure against most major rivals amid renewed sovereign debt worries in the euro zone, strategists said. The rhetoric from SNB members in recent weeks suggests that the bank will defend any attempt to breach the peg, so expect volatility in this pair as we believe the SNB will come in to defend this level, the Swissie immediately was bumped up as it fell to below the 1.20 price. Rumors are that the SNB intervened but no statement was made.

Asian –Pacific Currency

A rally on Chinese equity markets has helped the Australian dollar to recover from a three month low. The Australian dollar was trading at 103.05 US cents, up from 102.82 cents. The Aussie was at 84.74 Japanese yen, down from Wednesday’s close of 85.04 yen 78.36 euro cents, up from 77.88 euro cents. The currency had received some support from Chinese stock markets, which reopened after three days of public holidays.

The New Zealand dollar has eased after weak demand at a Spanish bond auction caused stocks on Wall Street to fall, reigniting fears the region’s sovereign-debt crisis is far from over. The New Zealand dollar fell to 81.40 US cents at 8am from 81.60 cents yesterday at 5pm.

Tepid demand at a Spanish government bond auction spooked investors who had been upbeat about global growth prospects and sparked a sell-off in higher-yielding, or riskier, assets. Reflecting the negative risk sentiment, the safe-haven US dollar and Japanese Yen strengthened against all of the major currencies pushing the kiwi dollar down. Against the Japanese yen, the euro fell 0.7% to ¥107.62. The dollar also slipped, buying ¥82.42, down from ¥82.57

Gold

Gold is currently making up losses from yesterday as the markets collapsed. Gold is trading at 1631.75 up 17.65. Gold continued to decline as U.S. dollars continued to strengthen. The latest economic data released helped strengthen the greenback: non-manufacturing PMI surveyed by the Institute for Supply Management. Service industries in the U.S. grew in March, though the actual figure was below what analysts anticipated, it was indeed a good figure. As a result, Comex gold futures prices ended the U.S. day session sharply lower and hit a fresh 11-week low, following a selling pressure from Tuesday’s losses.

Crude Oil

Crude prices rose yesterday rebounding from the previous session’s sell-off as investors did not want to spend the long weekend without some oil futures in their portfolios. Oil advanced $1.84, or 1.8%, to settle at $103.31 a barrel on the New York Mercantile Exchange. For the week, however, oil futures lost 0.3%.

Prices were enjoying “a little bit of a rally” following Wednesday’s selloff as investors also were buying ahead of the long weekend to guard against the potential for market-moving headlines. Oil futures fell $2.54 in the previous session, joining a global sell-off in the equity and commodity markets in the wake of the release of U.S. Federal Reserve meeting minutes and a flare-up in debt concerns in the euro zone.