Forex Markets

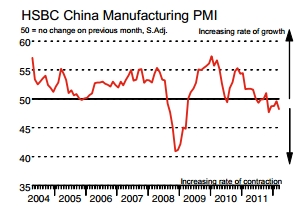

The Chinese official manufacturing Purchasing Managers’ Index (PMI), which was released Sunday for March reached 53.1 on a 100-point scale, up from 51 for February, according to China Federation of Logistics and Purchasing. The March reading in the official report was the fourth consecutive monthly increase. A final report from HSBC and Markit put the index at 48.3 for March, down from 49.6 in February. This reading has been below 50 for five months. The 50 level marks the difference between the manufacturing sector expanding or contracting.

Highlights from the Report:

[unordered_list style=”arrow”]

- Reduced factory output reflects falling new business from home and abroad

- Manufacturing employment down at sharpest rate in three years

- Input price inflation ticks higher, but remains modest overall[/unordered_list]

EUR/USD

The euro dollar ended the quarter on a surprise note, closing at 1.3332 gaining strength after Euro-zone finance ministers meeting in Copenhagen agreed to temporarily boost the size of the firewall designed to contain the spread of the region’s debt crisis to 800 billion euros ($1.1 trillion) from a previously planned 500 billion euros. IMF Director Christine Lagarde said she welcomed the decision by euro-zone finance ministers to temporarily boost the effective lending capacity of the region’s bailout funds to 700 billion euros. Ending the month, the US issued several economic reports all had positive sentiment, but the USD was unable to muster strength against the euro after the Copenhagen agreement.

In the US, consumer sentiment in March reached the highest in more than a year, as consumers grew more confident about their current economic conditions. The University of Michigan said the final reading for the consumer-sentiment gauge in March hit 76.2 — the highest since February 2011. Last month sentiment was at 75.3. The Chicago PMI, or Chicago business barometer by its formal name, decelerated in March but marked its fifth straight month above 60%. The PMI fell to 62.2% in March from 64.0% in February. Americans spent money in February at the fastest pace in seven months, but a good chunk of their cash went to pay for higher energy costs and incomes rose at a much slower clip, government data showed. Personal spending jumped 0.8% in February as personal income edged up 0.2%, the Commerce Department said.

Greek Prime Minister Lucas Papademos on Friday said the country was working to ensure it won’t need a third bailout but said the potential need for further aid couldn’t be ruled out, news reports said. “Some form of financial assistance might be required. France posted a 2011 budget deficit equal to 5.2% of gross domestic product, coming in under the government’s initial target of 5.7%, French President Nicolas Sarkozy reported. Inflation in the 17-nation euro zone slowed to a 2.6% annual pace in March, down from 2.7% in February, the European Union statistical agency Eurostat released today.

The euro jump seems to be an overreaction by investors, and the markets should see a correction developing on Monday, pushing the euro under the 1.32 level.

The Sterling Pound

The Sterling is currently at 1.5993, markets had earlier forecast the pound the break the 1.60 level which it did in today’s trading session reaching a high of 1.6036, the pound surprised most traders bouncing back after a few negative reports earlier in the week. There was no economic data out in the UK today and most US data was positive, ranging from consumer sentiment to consumer spending.

After EU Finance Ministers agreed to up the EMS and EFSF to close to a trillion euro value, investors were more confident and moved out of the USD. Sterling has advanced by 0.5% in March against the dollar, and by 2.9% in the year to date. The Sterling will see a reaction on Monday with the release of the UK Manufacturing PMI.

The Japanese Yen

The yen rose, not just as a traditional destination for safe-haven seekers but potentially as Japanese companies and investors may be selling foreign investments and repatriating profits as the end of the nation’s fiscal year is at hand. The dollar pared losses to ¥82.45 compared with ¥82.78 late Wednesday. The euro followed suit, dropping to ¥109.36 from ¥110.43. Risk aversion continues to be the main theme in the foreign-exchange market towards the yen. Trading in the currency may also be swayed by discussions of raising the country’s sales tax to cut its deficit, though such a move risks slowing consumption and the economic recovery. Exporters need the yen to trade higher than 82.00¥ to be profitable

Just released, the Tarkan Large Manufacturing Index, which disappointed remaining at the same as the prior months a -4 which signifies negative sentiment. At this time the yen is trading for 83.12¥ weakening since the release of the PMI report.

The Aussie

The Aussie rose to a high of 104.47 cents in today’s session after it was reported on Sunday that Chinese PMI activity rose for a fourth straight month in March. And then dropped to trade as low as 103.96 US cents after Australian Bureau of Statistics announced residential building approvals fell 7.8 per cent in February, which was below forecast. Chinese manufacturing data over the weekend got the Australian dollar off to a bright start to the week, with it trading close to 104.50 US cents. The currency is expected to remain weak, hovering around the 1.04 level, waiting for tomorrows RBA decision.

The Yellow Metal

Gold rallied Friday, ending the quarter up 6.7% and breaking a three-day losing streak as euro-zone finance ministers boosted the region’s firewall against the spread of the sovereign-debt crisis. Gold rose $17, or 1%, to end the day at $1,671.90 an ounce. That brought quarterly gains to 6.7%, which follows a 3.4% decline in the fourth quarter of 2011 and yearly gains of 10%.