Euro Dollar

The euro is plunging after FOMC minutes showed that the Fed is not motivated at this time for any bond program or QE. The euro is trading for 1.323 down 0.68% in just a few minutes.

Coming up in tomorrow’s US session:

[unordered_list style=”green-dot”]

- U.S. Treasury Secretary Timothy Geithner (January 2009 – January 2013) is to speak. He speaks frequently on a broad range of subjects and his speeches are often used to signal policy shifts to the public and to foreign governments.

- The ADP National Employment Report is a measure of the monthly change in non-farm, private employment, based on the payroll data of approximately 400,000 U.S. business clients. The release, two days ahead of government data, is a good predictor of the government’s non-farm payroll report. The change in this indicator can be very volatile.

- The Institute of Supply Management (ISM) Non-Manufacturing Purchasing Managers’ Index (PMI) (also known as the ISM Services PMI ) rates the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories. The data is compiled from a survey of approximately 400 purchasing managers in the non-manufacturing sector. On the index, a level above 50 indicates expansion; below indicates contraction.

- In Europe we start out the day with Eurozone Retail Sales measure the change in the total value of inflation-adjusted sales at the retail level. It is the foremost indicator of consumer spending, which accounts for the majority of overall economic activity.

- German Factory Orders measures the change in the total value of new purchase orders placed with manufacturers for both durable and non-durable goods. It is a leading indicator of production.

- The six members of the European Central Bank (ECB) Executive Board and the 16 governors of the euro area central banks vote on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation.

- The European Central Bank (ECB) press conference is held monthly, about 45 minutes after the Minimum Bid Rate is announced. The conference is approximately an hour long and has two parts. Firstly, a prepared statement is read, and then the conference is open to press questions. The press conference examines the factors which affected the ECB’s interest rate decision and deals with the overall economic outlook and inflation. Most importantly, it provides clues regarding future monetary policy. High levels of volatility can frequently be observed during the press conference as press questions lead to unscripted answers.

[/unordered_list]

The Sterling Pound

The Pound is currently trading for 1.5903, after starting the day over the 1.60 level. The USD has mustered strength on the FOMC minutes released a short while ago.

Wednesday bring us two important events in the UK:

The Halifax House Price Index measures the change in the price of homes and properties financed by Halifax Bank of Scotland (HBOS), one of the U.K.’s largest mortgage lenders. It is a leading indicator of health in the housing sector.

The Services Purchasing Managers’ Index (PMI) measures the activity level of purchasing managers in the services sector. A reading above 50 indicates expansion in the sector; a reading below 50 indicates contraction. Traders watch these surveys closely as purchasing managers usually have early access to data about their company’s performance, which can be a leading indicator of overall economic performance.

The Swiss Franc

This currency seems to be just sleeping through all the ups and downs of the markets. It barely registers a blip here and a pip there. The euro is falling into the danger zone as the SNB promises to get involved at the 1.20 level

Asian –Pacific Currency

The Australian dollar fell to its lowest level since January, after the US Federal Reserve indicated it would not be taking action to further stimulate the American economy. The Aussie dollar was trading at $US1.0294, having fallen from an opening price of $1.0331 on the news. On January 17, the Australian dollar hit a low of $US1.03. The local unit has fallen as low as $1.0287 in today’s trade.

Australia’s trade deficit has narrowed in February, against expectations of a surplus, according to data from the Australian Bureau of Statistics. According to the figures, Australia’s trade deficit for the month of February was a seasonally adjusted $480 million, an improvement of $491 million on last month. The result follows a downwardly-revised deficit of $971 million in January. Economists’ forecasts had centered on a surplus of $1.1 billion in February.

Activity in the Australian services sector contracted in March, as trading conditions weakened and the local currency stayed strong, a private survey shows. The Australian Industry Group/Commonwealth Bank Australian Performance of Services Index (PSI) rose 0.3 points to 47.0 points in March. A reading below 50 indicates a contraction in activity. Only two of the nine sub-sectors covered by the survey recorded rises in activity. They were finance and insurance, and personal and recreational services.

The high Aussie dollar is thwarting the prospects for trade-exposed service businesses and a lack of confidence among households is holding back the retail sector and service businesses.

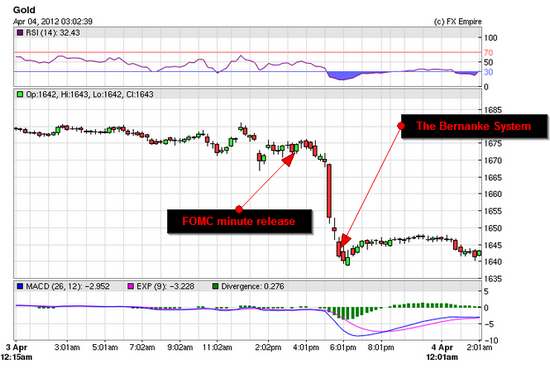

Gold

Gold futures added to losses after minutes from the Federal Reserve’s latest rate-setting meeting (FOMC) showed policymakers less interested in another round of large-scale bond purchases known as quantitative easing. Gold which had ended the Comex floor session down $7.70 at $1,672 an ounce, continued to fall after session. It was recently at $1,648.70, off nearly $31.

Investors have bought gold in recent years as a hedge against what they predict will be high inflation as a result of the Fed’s stimulus programs.

“Gold has now found itself without sufficient investor appetite to gain upward momentum but also a soft floor in light of weak physical demand,” said analysts at Barclays. “Demand from China has started to pick up but is only notably responsive to sharp price drops, while gold imports into Turkey have more than halved over the quarter,” they said.

Imports of gold by India, the world’s largest gold consumer, fell by over 55% in March, with jewellers shutting down their establishments across the country demanding a roll-back of the duty hike proposed in the Union Budget.

Gold Bullion imports shrank to 90 tonnes in the January-March 2012 period, as against 283 tonnes in the corresponding quarter of last year. In January, 40 tonnes of gold was imported, while in February around 30 tonnes was imported. The jewellers’ strike and the import hike in March depressed demand further.

In January, the government hiked the gold import duty from 1% to 2%. Again in March, import duty was doubled to 4%. Speaking about the decline in imports, jewellers said high interest rates and inflation were also affecting consumption of the precious metals.

In January, the government hiked the gold import duty from 1% to 2%. Again in March, import duty was doubled to 4%. Speaking about the decline in imports, jewellers said high interest rates and inflation were also affecting consumption of the precious metals.

Crude Oil

Crude Oil dipped to trade at 103.95 down 1.27. U.S. weekly oil data are expected to show crude-oil stocks rose last week while refiners modestly increased operations. According to estimates from 15 analysts surveyed by Dow Jones Newswires, U.S. crude-oil inventories rose by 1.9 million barrels.

The EIA is scheduled to report its weekly data on inventories early Wednesday, with the American Petroleum Institute trade group slated to report its own data later Tuesday. Analysts polled by Platts forecast an increase of 1.9 million barrels in crude for the week ended March 30. Gasoline stockpiles are seen down 1.6 million barrels on the week, while supplies of distillates are expected to decline 600,000 barrels. That would follow a surge of 7.1 million barrels for crude in the previous week.

“Increases at this time of the year are expected as refineries are in their maintenance period before summer driving season”, said Tom Bentz, director at BNP Paribas in New York. Speculators want to see the inventories numbers before they make their next move.