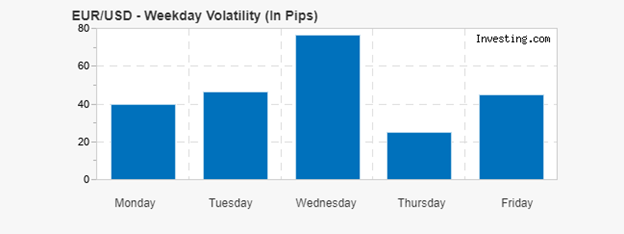

ADR stands for Average Daily Range, which means that every market in forex trading has a unique range that covers the whole single day. ADR provides you with the actual content on which the instrument is trading on that day. ADR helps you to enhance the win rate in trading just by filtering out entries. The article will discuss ADR usage, a handy trading tool, and provide important information. It includes information on the daily volatility of currency pairs.

Opportunities in short term trading by ADR

- The Average Daily Range indicates the average pip spread of a Forex pair over a specified number of periods. For instance, if the average daily pips are 100 and the instrument surged to 80 pips, it won’t be good as 20 pips remain in the ADR.

- Moreover, the ADR can assist you in setting goals for current positions. For instance, if the ADR indicates that a Forex pair’s average daily range is 100 pips, it may be prudent to tighten your specific goal if a price move reaches or approaches this expected range.

- Moreover, the ADR is useful for traders’ intraday reversals. For instance, if a currency pair hit the peak of its daily range, it may be due to just a regression, and you may wish to consider a bullish strategy to profit from a possible retracement.

Calculation and usage of ADR for trading

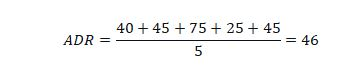

ADR can be calculated using this formula, but it can be done using various trading apps tools.

ADR = (n1 + n2 + n3 + n4 + n5) / # of periods

(where n is the high low range in pips for the defined day)

For instance. In the following graph, there are counted pips of the five days so that ADR would be;

So, ADR= 46

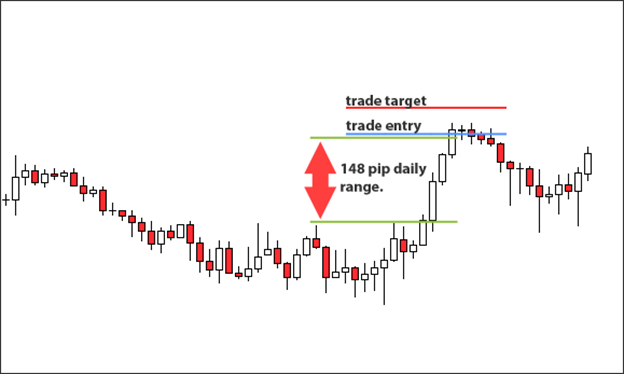

To construct the current ADR range, you must first determine the current daily low and high. Then, to regulate the higher & lower parameters of the ADR upon this graph, apply the following formula:

- To create the upper ADR standard, you would have to start with the daily low and work your way up.

- To create the lower ADR standard, you would have to subtract the ADR value from the daily high.

Unfortunately, the ADR indicator is not incorporated in MT4default, but you can download and add it in MetaTrader.

Trading strategy

- Enter a trade whenever the price action starts to break out of the ADR range in the way of the breakout or when the price movement jumps off one of the ADR stages

- When trading a breakout, place a stop order above the broken level. Keep restricting the loss above the formatted swing level if you’re trading a bounce.

- If you’re trading a breakout, try to keep the position in the trade until the price action attains until the trading day closes. If you’re trading a bounce, try to keep the position until the price action attains until the end of the trading day.

Bottom line

Without the knowledge of the ADR, a trader might lose all of his money against making money. Traders may use the Average Daily Range to forecast price activity that is exterior to the daily average. Traders can set their targets by using ADR, which helps manage trading positions in a better way.