How Do You Find M And W’s With Forex?

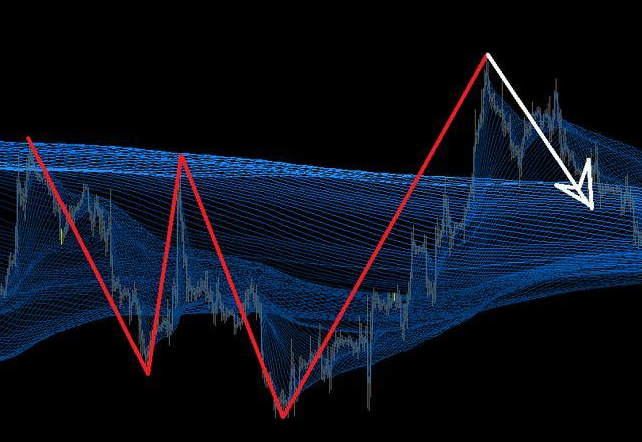

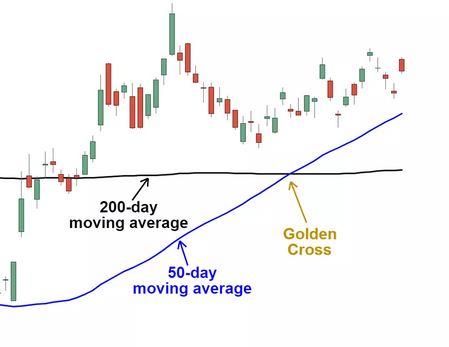

The Forex market allows investors to profit by trading different currencies, making it lucrative. You must understand the market dynamics and the various strategies to make profitable trades to succeed in Forex trading. Among the most effective trading strategies are the use of the m and w patterns. Forex traders use the M and W […]

How Do You Find M And W’s With Forex? Read More »