The Forex market allows investors to profit by trading different currencies, making it lucrative. You must understand the market dynamics and the various strategies to make profitable trades to succeed in Forex trading. Among the most effective trading strategies are the use of the m and w patterns.

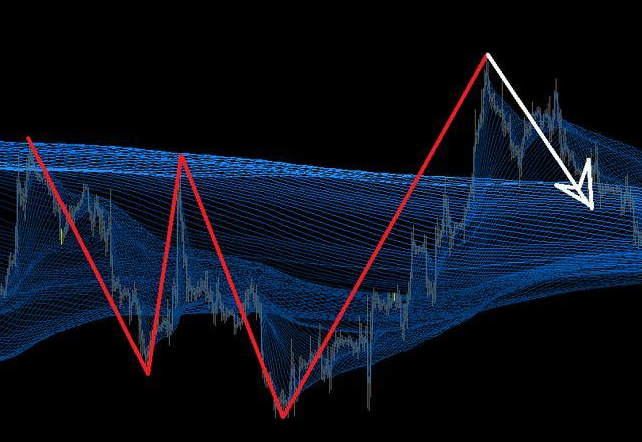

Forex traders use the M and W pattern trading strategy to identify potential trend reversals. It is possible to identify a potential trend reversal by identifying patterns like the letter “M” or “W” on a price chart. Using the pattern, you can enter a profitable trade when there is a potential trend reversal.

What Is The W Trading Pattern?

W patterns form when two consecutive higher lows follow by higher highs after a downtrend in which the W pattern has formed once the neckline (resistance line) has retreated.

Usually, a W trading pattern forms when a series of down-ticks follows an up-tick, followed by a series of down-ticks. This is also known as the double bottom pattern. This forms a “W” shape on the chart. Buying the stock is good if a W pattern appears on a chart since the market will likely rise.

What Is The M Trading Pattern?

During a series of upticks followed by a series of downticks, followed by another series of upticks, the M trading pattern is formed. As a result, it forms an “M” shape on the chart, indicating a bearish market move. It’s also called the double-top pattern. When an M pattern appears on a chart after an uptrend, it’s a bearish reversal pattern. If you see one on a chart, you should sell the stock since the market will likely move downward.

Steps To Find M And W’s

Understanding technical analysis and reading price charts effectively to find m and w patterns is essential. To do this, follow these steps:

Step 1: Identify the trend

To identify m and w patterns, it is necessary to identify the trend’s direction. Analyzing the price chart with technical indicators such as moving averages, trend lines, and support levels is possible. When there is a bullish trend, look for w patterns; when there is a bearish trend, look for m patterns.

Step 2: Identify the pattern

Following identifying the trend, you should look for an m or w pattern. An m pattern forms when two consecutive lower highs follow by a double bottom, while a w pattern forms when a double top follows two higher lows. A pattern must be clear and distinct, and the price shouldn’t break its middle point.

Step 3: Confirm the pattern

When a pattern is identified, other technical indicators should be used to confirm it. The pattern can be confirmed using indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Stochastic Oscillator. Indicators like these can tell you if the market is oversold or overbought, which may indicate that the trend is about to reverse.

Step 4: Enter the trade

When the pattern is confirmed, you can enter a trade. If trading a W pattern, you should buy when the price exceeds the middle point. A short position occurs when the price breaks below the middle point of an M pattern. Set your stop loss and take profit levels depending on your risk tolerance and trading strategy.

Bottom line

You can identify potential trend reversals in forex trading with the help of m and w pattern trading, a simple and effective forex trading strategy. M and W patterns require good technical analysis skills and an understanding of price charts. Use other technical indicators to confirm the pattern before entering the trade. M and W pattern trading can help you become a successful forex trader with practice and patience.