The pin bar reversal is one of forex traders’ most popular price action strategies for a good reason.

We’ll let you know how to trade the pin bar reversal today, including how it works and what makes it tick.

So, let’s get started!

Identifying Pin Bar Reversal Pattern

Have you seen a candlestick with a large wick? It just resembles the pin bar.

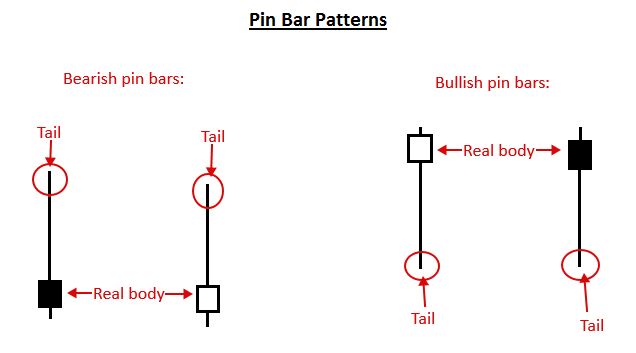

A single price bar makes up a pin bar pattern, usually a candlestick price bar that signifies a sharp price reversal and rejection. The long tail of the pin bar reversal, also known as a “wick,” distinguishes it from other types of reversals.

This is because a pin bar’s “real body” is the space between its open and close positions, and pin bars have small natural bodies concerning their lengthy tails. The longer the tail, in fact, the better it is.

Thus, a bearish pin bar signal has a lengthy upper tail, indicating rejection of higher prices and implying that price would decline shortly.

Conversely, a bullish pin bar signal has a lengthy lower tail, indicating rejection of lower prices and suggesting that prices will climb in the short term.

If the candle’s body is white or green, the closing price is greater than the opening price, and if the candle’s body is black or red, the closing price is lower than the opening price, just like any other candle on a candlestick chart.

Trading Pin Bar Reversal

To employ a pin bar trading method, you must first analyze the candlestick chart of the currency you wish to trade and the time frame you are most comfortable trading.

Pin bar trading tactics are more effective over longer time frames: one hour, four hours, and one day. However, they are unable to work in shorter time periods.

Once you’ve located the ideal setup for a pin bar reversal, you must select when to join the market and where to put your stop order.

When the pin bar has formed, put a market order ten pips above the closing price for a bullish pin bar and ten pips below the closing price for a bearish pin bar.

For both a bullish and bearish pin bar, the stop should be priced near the end of the pin bar tail.

Simply said, the pin bar is one of the most adaptable pricing patterns known to man. You may use it on its own as a signal to take profits or combine it with other indicators like support and resistance levels, trend lines, and Fibonacci retracements, to name a few.

It would be hard to include all trades pin bars methods. So I’ve listed the most profitable ways.

Pin Bars at Support and Resistance Levels

The most well-known and perhaps best in the forex market to trade pin bars is crucial support and resistance levels.

Pin bars and S & R levels aren’t handy on their own. Pins frequently fail to produce reversals, and the price occasionally breaks through S & R levels as if they don’t exist.

However, when a pin bar appears at a support or resistance level, the likelihood of a reversal increases considerably, making it a powerful and accurate trading method.

A bullish pin bar is formed at the level of support. Mark several levels on your chart and then wait for the price to hit one of them to trade pin bars at support and resistance levels.

Once this occurs, keep an eye on the price to see if a bullish or bearish pin bar appears. Again, look for bullish pins at support levels and bearish pins at resistance levels.

Pin Bars at Fibonacci Ratios

Fibonacci ratios can assist in determining an even prudent financial ratio. On the same bearish pin bar pattern, these are the measures to take:

Measure the pin bar’s length from its highest to the lowest position; use the Fibonacci Retracement tool to determine the 50% levels, and wait for the market to revert to the stated region.

Traders might stay for the same take profit while taking a reduced risk this manner. As a result, Fibonacci complements the unique pin bar trading approach by providing an even better risk-reward ratio. Isn’t it impressive for a single candlestick pattern?

Pin bar methods are powerful technical analysis tools for traders and should be part of your trading toolkit.

The pin bar is not only novice-friendly but also incredibly effective because of its long, easy-to-spot wick and inclination to foresee reversals.

Bottom line

Pin bar reversal patterns are incredibly profitable when the pin bar’s structure is nearly flawless and breaks through a significant barrier or support price before being rejected.