A variety of people populates the forex markets. As a result, different traders use different patterns to succeed. In this article, you’ll learn how to identify the piercing patterns and trade in them?

What is a Piercing Pattern?

The piercing pattern is a two-day candle pattern that indicates a possible trend reversal from downward to upward.

Identifying Piercing Pattern

A Piercing Pattern is made up of two components;

Bullish Piercing Pattern

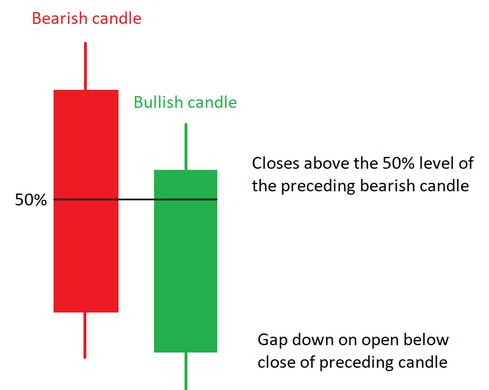

The Bullish Piercing design comprises two candles, with the second candle opening below the closure of the first but closing around its body, giving the impression of piercing it.

This pattern has a gap, which is the starting price of the second candle relative to the closing price of the first candle.

The Bullish Piercing is an upside reversal pattern that occurs following a downward trend. It can be used to validate negative trend responses or corrections.

Bearish Piercing Pattern

The Bearish Piercing pattern comprises two candles, with the second candle shutting below the first candle’s closure but opening above it, giving the impression of piercing it.

The Bearish Piercing is a downside reversal pattern that occurs following an upward advance. It may be used to validate bullish trend responses or corrections.

Trading Piercing pattern

Technical analysts use different indicators to validate a purchasing signal provided by a Piercing pattern. Because a Piercing pattern implies that bears have lost control, a bullish trend is more likely.

As a result, the bulls have reclaimed the power of the market, as seen by the substantial jump on the second day. This victory of the bulls over the bears is regarded as a buying signal.

Although a Piercing pattern indicates a trend reversal, experts advise against relying only on it. Instead, further support indications should be combined with the Piercing pattern. In addition, when using a reverse trading technique, the effectiveness of the piercing pattern is increased.

Long traders enter at a low point in an asset’s price action and capitalize on increases in an asset’s price, while short traders sell at a high point in an asset’s price movement and buy back in when the price declines.

A strong trend in the price movement of an asset is required, with obvious downtrends possibly projecting bullish piercing patterns and clear uptrends forecasting bearish piercing patterns.

When an asset approaches support (bullish piercing pattern) or resistance level, a trading opportunity exists (bearish piercing pattern).

A trade entry point exists when the second candle in the pattern passes the 50% mark of the first candle’s body. If the price falls to the starting price of the second candle, it would be a reasonable stop loss.

A take profit point might be placed at any point 10% past your entry point, with traders with a more significant risk tolerance likely to put it higher if they are convinced a reversal is present.

Suppose the reversal appears to be petering out in subsequent candles. In that case, it may be a good idea to exit the trade ahead of your take profit.

The second candle in the pattern could have been a short-term correction in an asset’s momentum, with a breakout past an S & R level posing a real threat to cause significant losses.

Along with trading this pattern as a stand-alone strategy, we can now consider combining it with other technical features, mainly when confirming divergences in momentum oscillators such as MACD.

Bottom line

Creating confluence between technical approaches is one of the most acceptable ways to analyze and trade the market since it increases our chances of success with our trade idea.