VIX is informal for the Chicago Board of Options Exchange Market Volatility Index (CBOE). The volatility index is also called the “fear index.” It is the prevalent trading tool in the financial market. It is also frequently used by stock and options traders.

What is VIX?

The volatility index measures how prices undergo sudden and unanticipated movements in the market. CBOE VIX, in particular, measures implied volatility. It is not a percentage but can be considered one for our understanding.

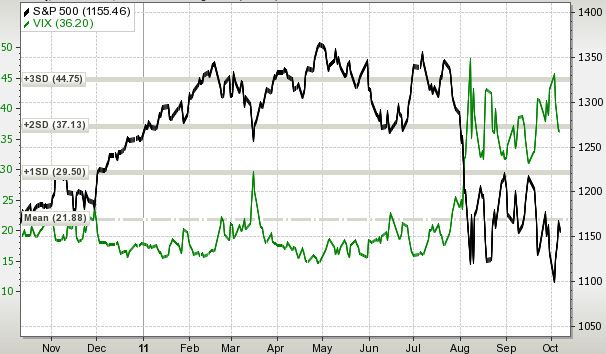

The VIX measures stock market prices with 30 days to expiration, based on S&P 500 Index options (SPX) in the United States.

To put it in simpler terms, it measures how much a market will fluctuate over the next twelve months. This is done after analyzing the difference between the present S&P 500 Index option puts and call option prices.

A put option is an option contract where the buyer has the right to buy stock within a particular time and at a specific price. A call option is the same as the put option, but the buyer sells specified stock instead of buying it.

What is Volatility?

Volatility is a measurement for the standard deviation of market prices over time. We can deem volatility as a measurement for market uncertainty. Specifically, it is the relative instability of prices.

We can use volatility to determine the frequency and magnitude of price changes over time. Low volatility means less drastic price movements.

We can construe realized volatility or historical price changes through volatility. We can also predict future volatility by using option prices.

How is VIX Calculated?

By clustering weighted prices of S&P 500 Index puts and calls over a diversity of prices are gauged by the VIX index. When calculating VIX, we take relevant prices as midpoints of real-time SPX option price quotations (bid / ask).

A VIX of 30 means the volatility is 30 % on the SPX. The VIX will rise if the put option increases and falls if the call option is in a more significant operation. Low fear also means a more complacent market.

How is VIX used?

The VIX provides us, the market participants, with 30-day expected volatility of the stock market of the USA. We can assume that the S&P 500 Index will be more volatile if the VIX shows a rise graphically.

If a value is greater than 30, we can safely surmise that it is a volatile market. Similarly, a value below 20 depicts a steady market.

As mentioned earlier, VIX is also the fear index. So, a higher VIX means more fear, and a lower VIX means lower fear.

When and Where Does the VIX Trade?

The VIX enables us to replicate volatility exposure with various SPX options. It has allowed us to create tradable VIX features and options. It is not, however, tradeable itself.

The VIX can be calculated and promulgated fast enough to provide accurate time volatility information when needed.

We also have weekly and monthly VIX expiration options during regular trading hours and limited trading hours in the U.S. and worldwide, respectively.

Bottom line

When the VIX is declining, indicating the likelihood of more stock market stability, it may be more beneficial to concentrate on individual stocks or other risky assets that may do well during periods of growth.