Remember April 6, 2012 is a holiday and most markets are closed. The US will release the Non Farms Payroll report on Friday. Many markets are closed on Monday also. Trading volume will be light today and on Monday.

Euro Dollar

USD- U.S. Non-Farm Payrolls and Employment Situation, the main indicator of U.S. economic health measuring job creation and unemployment, Fri., Apr. 6, 8:30 am, ET.

Even though job creation is forecast to not be as strong as it was in the previous month, the positive trend in the U.S. labor market would be likely to continue with the economy adding another 200K jobs in March, compared with 227K in February, while the unemployment rate stays at the current 8.3% level. As long as the U.S. job market continues to demonstrate consistent improvement, the USD should benefit from reduced QE3 odds.

The dollar lost ground against major rivals during Asian trading hours Thursday, while the euro recovered slightly from losses triggered by fresh European debt worries. The ICE dollar index which measures the greenback’s performance against a basket of six other currencies fell to 79.670, from 79.764 late in North American trade Wednesday. The euro inched up to $1.3154, from $1.3139 late Wednesday.

The Sterling Pound

GBP- Bank of England Interest Rate Announcement

The Bank of England’s March meeting minutes surprised the markets with two Monetary Policy Committee members voting for additional expansion of the Asset Purchase Program. However, considering that the majority of the committee still does not share their view, the central bank should refrain from doing more quantitative easing for another month. The record low benchmark rate will also be maintained at the 0.5% level. As long as the Bank of England does not steer too far from the current course and the Fed doesn’t “shock and awe” the greenback with a QE3 announcement, the GBP/USD pair should continue to do more of the same, fluctuating in its multi-month range where it has been stuck since last October.

The British pound rose to $1.5902 from $1.5890 ahead of a Bank of England policy meeting The strength of the greenback was able put pressure on all of its trading partners after the release of the FOMC minutes, which showed that the Fed has no interest at additional bond purchases or monetary easing.

The British pound rose to $1.5902 from $1.5890 ahead of a Bank of England policy meeting The strength of the greenback was able put pressure on all of its trading partners after the release of the FOMC minutes, which showed that the Fed has no interest at additional bond purchases or monetary easing.

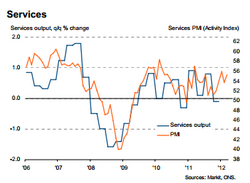

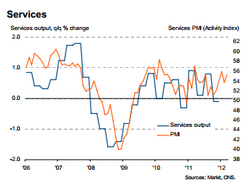

The sterling was also supported with some unexpected positive economic news today. The final reading of the Markit euro-zone composite purchasing managers index, or PMI, for March rose from a preliminary estimate but still pointed to a contraction in business activity in the 17-nation region last month and over the first.

A gauge of activity in Britain’s dominant services sector unexpectedly rose in March, data showed Thursday. The CIPS/Markit purchasing managers’ index, or PMI, for the sector rose to 55.3 from a reading of 53.8 in February.

Chris Williamson of Markit said that the strength of the economy as reflected in these surveys would stay the BOE MPC’s hand on further asset purchases in coming months.

[quote]PMI data signalled that UK economic growth picked up in March to round off the strongest quarter for a year. The surveys therefore indicate that the UK economy has escaped a slide back into recession, and also suggest that the Bank of England will hold off on further asset purchases unless the economic situation deteriorates in coming months[/quote]

Williamson said that the upturn in business confidence in both construction and service sectors bodes well for future growth, though he warned that soft underlying order books might weigh on manufacturing. The Queen’s Jubilee celebrations could also be expected to dampen GDP growth, Williamson said.

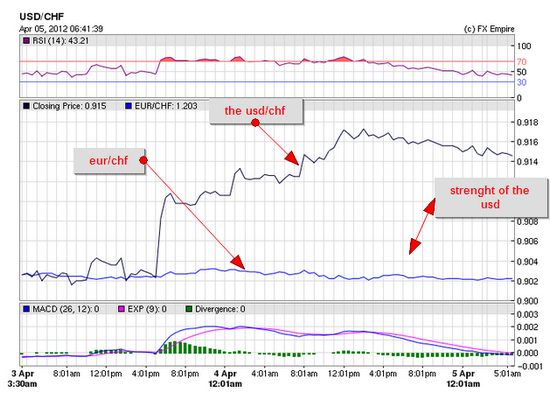

The Swiss Franc

The euro continues to fall dropping against the Swissie moving dangerously close to SNB intervention. The pair is trading this morning at 1.2038 after falling to a low of 1.2030.

The Swissie is trading against the USD at 0.9148

The Swissie is trading against the USD at 0.9148

Asian –Pacific Currency

The Australian dollar has failed to stage much of a recovery after hitting a three-month low. The Aussie has been weighed down by a combination of factors: worries over Spanish government debt, poor Australian trade figures and the likelihood of a Reserve Bank of Australia rate cut in May. It has also been hit by a rally in the US dollar after the US Federal Reserve indicated it would not embark on more economic stimulus programs.

The Australian dollar was trading at 102.65 US cents, down from 102.82 cents

Gold

Gold futures plunged to a 12-week low while silver fell 6.7% as quashed hopes of easy money unleashed a wave of selling across commodities and equities. The most actively traded gold contract, for June delivery, fell $57.90, or 3.5%, to settle at $1,614.10 a troy ounce on the Comex division of the New York Mercantile Exchange.

Gold and other precious metals were caught in a broad market selloff, which spread across commodities and equities as traders adjusted their expectations of U.S. monetary policy in the wake of Tuesday’s Federal Reserve meeting minutes.

The bank’s policy-setting arm snuffed out hopes of imminent monetary stimulus and hinted that interest rates could rise before 2014. At this point investors have major re-pricing across all asset classes going on and I don’t think it’s over, gold prices could run down to between $1,550 and $1,580 a troy ounce.

Crude Oil

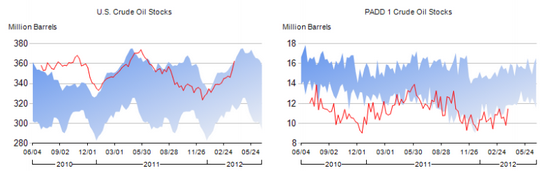

Oil prices bounced off seven-week lows in electronic trading Thursday, as the dollar’s weakness and an increase in U.S. stock-index futures helped offset concerns about rising American crude-oil inventories. Futures on light sweet crude oil climbed 76 cents, or 0.8%, to $102.23 a barrel during afternoon hours in Asia on Thursday. The front-month contract had declined $2.54 on the New York Mercantile Exchange Wednesday, with the move coinciding with a broad sell-off in the equity and commodity markets.

It was also supported by a major surprise in inventory as reported by the EIA. The Energy Information Administration reported crude stockpiles rose by 9 million barrels — nearly five times the 1.9-million-barrel increase expected.