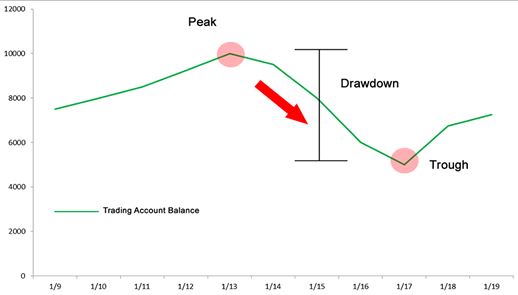

A drawdown occurs when the balance of your forex trading account varies from one high point to the next low point. Due to losing trades, your balance reflects a loss of capital.

Suppose your currency trading account begins with a $100,000 balance and loses money on trades. This is known as a “drawdown.” Suppose you are working your trading system, making a bad trade, and your account equity falls to $95,000. You have experienced a $5,000 loss on your account. Read on to find out more about drawdown in trading.

What can you learn from a drawdown?

You can also look at drawdowns to measure how long your system will likely survive. In the event of a large drawdown, an investor finds themselves in an untenable situation.

A client who endures a 50% drawdown faces a significant challenge because they need a 100% return on their reduced capital stake to break even on the reduced equity position.

If a Wall Street investment or fund manager averages 20% profit for the year, they are ecstatic. When a trader suffers a drawdown, they should implement risk-management procedures and re-adjust their system rather than continuing to trade aggressively until they recover.

Trading aggressively to break even and recover capital usually yields the opposite result. Exactly why? They will likely use leverage and over-trade to get their trading account back to where it once was.

Too much leverage

Due to the high cost of opening trades with cash, most traders use leverage. Excessive leverage can create problems for a trader. As a result, it’s much more difficult to recover losses, maintain margins, and lose your entire account within seconds.

Note

One good trade is unlikely to make your trading career, but one bad trade is certain to do so.

Overleveraged traders risk losing all their money with one bad trade-and they often do. It is common for traders to take too many risks after experiencing a loss. Losses are usually large, or they refuse to accept a losing trade that should end as a result.

Recommended reading

In terms of a book that outlines the emotional toll of drawdowns, What I Learned Losing a Million Dollars by Jim Paul and Brendan Moynihan is a good choice. It describes how a trader lost his career, his family’s fortune, and his friends’ money after taking a large drawdown.

Additionally, the book provides several tips on avoiding common trading pitfalls, such as making a trading plan based on emotions instead of risk management.

Bottom line

A valuable tip you’ll hear is always to set a stop-loss or stop-market order before you enter a trade. You will take less drawdown that way. Investing decisions should not be based on emotion. Rather than maximizing profits by entering and exiting trades early, focus on managing risk.

When and if your stop-loss level reaches, you can stand back after entering a trade, knowing that you’re out of it without any questions.

It is common for traders to remain in losing trades, hoping that a change will eventually come. Rather than making the best trades based on strategy, you’ll make them based on emotion. It’s easiest to stay in a losing position. Nevertheless, it isn’t necessarily more beneficial in the long run.