Regular readers of our blog, who subscribe to our weekly Sunday evening “is the trend still your friend?” articles, will have noted that we use several of the most popular indicators in our technical analysis. They are (in no particular order); PSAR, Bollinger bands, MACD, DMI, stochastic lines, RSI and ADX. These seven offer up, for the majority of our readership, extremely effective and simple observational methods of gauging market sentiment and therefore the direction of the market that we should, in theory, be following.

Regular readers of our blog, who subscribe to our weekly Sunday evening “is the trend still your friend?” articles, will have noted that we use several of the most popular indicators in our technical analysis. They are (in no particular order); PSAR, Bollinger bands, MACD, DMI, stochastic lines, RSI and ADX. These seven offer up, for the majority of our readership, extremely effective and simple observational methods of gauging market sentiment and therefore the direction of the market that we should, in theory, be following.

Over the coming weeks we’re going to analyse each of these indicators individually and then put into practice the most simple use of each one in a trading situation in isolation. We’re not going to use it, as in our weekly analysis with a combination of other indicators, we’re going to describe and then use each one individually. In the first article of this series we’ll be concentrating on Bollinger bands and we’ll finish with a really simple practical trading example of putting the BB to use.

On first inspection Bollinger bands can look over complicated and yet they offer, as a snapshot, one of the most effective indications of where the market can be headed versus many other of our favoured indicators. Moreover, the use of the bands can be quite extensive. The outer bands, the upper and lower, are typically used as oversold and overbought areas whereas the middle band is often used by traders as part of a break out strategy. The BB also offer up a bi product to their observational qualities as they also exhibit volatility values, a value that’s tricky to determine when using other indicators. In essence BB are made up of firstly a simple moving average, the 20, secondly this MA is then combined with two what are termed “standard deviations” from that average – the upper and lower bands.

We must stress at this stage that all our analysis relating to the use of BB will be based on the daily time frame only, and the BB will be left on their standard settings. Before we go any further a description and history of the Bollinger bands would be appropriate.

Bollinger bands, a quick reference

Bollinger Bands are a technical analysis tool invented by John Bollinger in the 1980s, and a term and concept he trademarked in 2011. Having evolved from the concept of trading bands, Bollinger Bands and the related indicators and bandwidth can be used to measure the “highness” or “lowness” of the price relative to previous trades and levels. Bollinger Bands are in many ways a volatility indicator.

The purpose of Bollinger Bands is to provide a relative definition of high and low. By definition, prices are high at the upper band and low at the lower band. This definition can aid in pattern recognition and is useful when comparing price action of candles to the action of indicators in order to arrive at systematic trading decisions.

Using Bollinger bands

The use of Bollinger Bands varies widely among traders. Some traders buy when price touches the lower Bollinger Band and exit when price touches the moving average in the center of the bands. Other traders buy when price breaks above the upper Bollinger Band or sell when price falls below the lower Bollinger Band. Bollinger Bands are not confined to one particular set of traders as: equity traders, FX traders, index and commodities traders often sell when Bollinger Bands are far apart, or buy when the Bollinger Bands are close together. In both circumstances we expect volatility to revert towards the average historical volatility level for the security.

Volatility with BB

When the bands lie close together, a period of low volatility is indicated. Conversely, as the bands expand, an increase in price action/market volatility is indicated. When the bands have only a slight slope and remain parallel for an extended period of time, price will generally be found to be oscillating between the bands as though price is locked in a trading channel.

Use in trading

Traders often use Bollinger Bands with other indicators in order to confirm price action. The use of an oscillator like Bollinger Bands will often be twinned with a non-oscillator indicator such as chart patterns via the use of candles/price action, or trend-lines, or simple moving averages. If these indicators confirm the position of Bollinger Bands, traders may have greater conviction in their trade direction.

Various studies of the effectiveness of the Bollinger Band strategy have been performed, with mixed results. In 2007 there was analysis published using a variety of formats; different moving averages, time frames and markets (e.g. Dow Jones, FX and equities). Analysis of the trades, spanning a decade from 1995 onwards, found no definitive evidence of consistence performance with all measurements being judged versus a simple buy and hold strategy as a benchmark. However, the analysis discovered that a simple reversal of the strategy produced positive returns in a variety of markets, suggesting that selling when the upper BB is breached and buying when the lower Bollinger is breached could be effective.

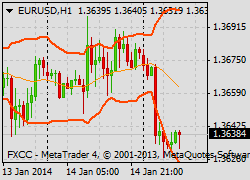

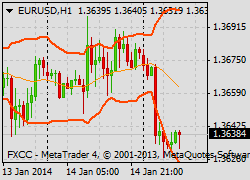

Trading example; the Bollinger breakout

Breakouts occur after a period of price consolidation, when price closes outside of the Bollinger Bands. Other indicators such as support and resistance lines can prove beneficial when deciding whether or not to buy or sell in the direction of the breakout. If the support line S1, or resistance line of R1 breaks in tandem with the upper or lower Bollinger band being breached to the downside or upside (lower or higher BB) then the indication is that the momentum move will be stronger. These two strategies are really simple and offer up an excellent introduction to the use of BB.

Bollinger Band Breakout through Resistance Buy Signal

Price breaks above the upper Bollinger Band after a period of price consolidation. Other confirming indicators are suggested, such as resistance being broken. The stop is placed at the middle Bollinger band, whilst taking care regarding key looming round numbers, that they aren’t a magnet for various orders close to the middle Bollinger.

Bollinger Band Breakout through Support Sell Signal

Price breaks below the lower Bollinger Band. It is suggested that other confirming indicators be used, such as a support line being broken. Once again the stop is placed near to the middle Bollinger band with the obvious caveat that traders observe that key looming round numbers are not in the immediate vicinity.

Comments are closed.