If you think from the title that most exotic forex pairs mean the most lucrative, you are partially right since they are also the riskiest. There is always a risk in forex trading. But how much the trader is willing to take depends on their mindset. As you read this article, you will better understand the liquid and exotic pairs and how to trade them.

Should you trade exotic currency pairs?

If you are confident and smart enough to trade any pair, you can trade it. There is a lot of volatility associated with exotic pairs, and that volatility can also help you increase your earnings. When you are a novice, it can also work the other way around.

The term volatility refers to the frequency with which prices change. High volatility is always a plus for day traders, and for forex traders, it is also a plus. It is simply because a trader wouldn’t sell and make a profit if the currency price did not change.

To gain a better understanding of this fascinating ocean of most liquid and exotic pairs, it is recommended that you start trading the most popular exotic pairs first.

The most liquid exotic pairs

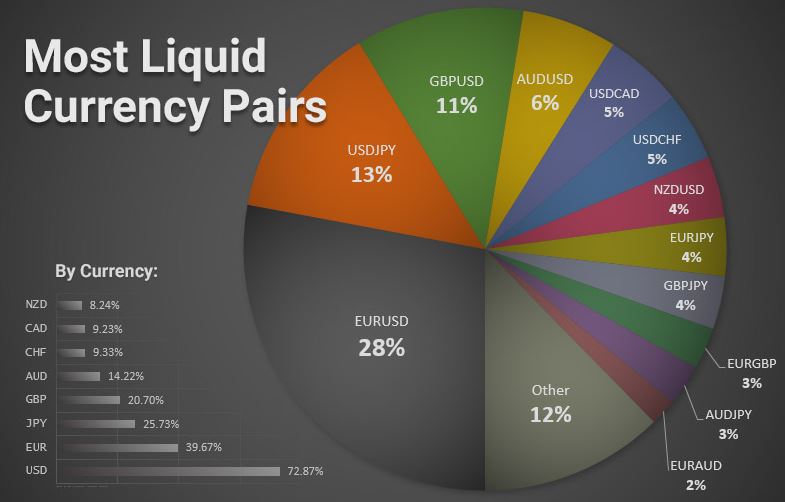

The liquidity of an asset is defined as the rate at which transactions are carried out. Buying and selling currency is easier if it frequently occurs because you will be able to find a match at your preferred rate.

Exotic pairs have less liquidity due to the difficulty of finding a trader who matches your price preferences. It is easier to trade major and minor currency pairs because of the large volume of transactions.

Several exotic pairs have been most liquid in the last decade, such as USDSEK, USDNOK, USDMXN, GBPSEK, USDZAR, MXNJPY, and GBPTRY. These numbers change every day due to the volume and volatility of the exchange rate.

In the TradingView forex screener, you can select exotic currency pairs and add volume and technical trend indicators if you want to analyze exotic currency pairs.

Exotic pairs and the risk involved

Several factors influence exotic currency pairs, such as interest rates, the country’s economic strength, direct foreign investment, and others. Understanding the risks involved in exotic pairs is the first step you should take. The best way to do so is to understand the relations between those two countries and how they interact.

Traders from developing countries most commonly trade exotic pairs. Consequently, they better understand how the economy impacts trading in a country.

Many currency pairs trade at a higher risk than major and minor forex pairs. The liquidity of exotic pairs is also lower than that of the majors and minors.

Exotic pairs trading: brokers matter

It is important to check with your broker about their services before trading any exotic pair. Most brokers only offer major and minor pairs, while many charge high fees for trading exotic pairs.

To make a profit, brokers must charge higher for exotic pairs because they are a risky investment. Some brokers also prefer their traders to have a large position to balance it out for a lower pip value.

Brokers, however, suggest that a short trade would be more beneficial – it could be a swing trade or a carry trade. When trading exotic forex, you should know that the spreads are wider, resulting in increased risk, fees, and capital requirements.

Bottom line

Any pair which is not major or minor can be considered as exotic pair. Traders who can read between the lines have an advantage over those who trade major or minor pairs since exotic pairs are more predictable.

Exotic pairs have little information and little research available on the market; there are also language barriers because most exotic pairs are from countries where English is the first language. If you want to know the expected changes in exotic pairs, you must follow the events in exotic nations. Beginners should trade major or minor pairs rather than exotic pairs because they are less risky.