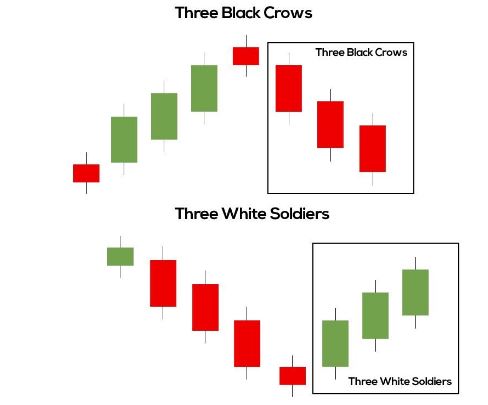

Talking about three white soldiers, it is a bullish candlestick pattern responsible for predicting the reversal of the current downtrend in any pricing chart. This entire pattern is based on three consecutive long-bodied candlesticks which open through the previous candle’s real body and closing that exceeds the previous candle’s high.

These candlesticks do not have a long shadow, and they ideally open within any real body of the preceding candle in the pattern.

How are the three white soldier’s patterns considered valid?

Three white soldier pattern is in the shape of the staircase with each open above the previous day’s opening. The next candlestick is holding the middle price range of the previous day.

Every candlestick should be creating a new high in comparison to the previous candle. To let the pattern be displayed as valid, you have to:

- The second candlestick has to be bigger in comparison to the body of the previous candle.

- The second candlestick should be closing near the high by leaving a non-existent and a small upper wick.

- The last candlestick needs to be the same size and should have a no or small shadow compared to the second candle.

How can you identify three white soldiers?

For identifying this pattern, you have to search for three consecutive white or green candlesticks. Each one of them should close and open itself high in comparison with the first one.

These candlesticks should have small or no wicks with big bodies. You will likely notice this pattern at the bottom of the downtrend.

Once the three soldier pattern has been formed, you will notice a short consolidation period. But the short and intermediate-term bias will stay bullish.

How to trade with three white patterns?

When it comes to starting trading with three white soldier’s patterns, a trader can choose various ways to start successful trading. You have to first confirm the signal by using suitable technical indicators. This can be either a stochastic oscillator or even a relative strength index (RSI).

With the help of indicators, it gets easier to smoothly validate the candlestick signals and get a deeper insight into numerous price trends.

With the three white soldier’s candlestick pattern, you can start trading using certain derivatives such as CFDs or spread bets. It gets easier to trade in falling or rising markets with such financial products because you are not taking ownership of underlying assets.

For opening a position, you have to:

- Create an ID trading account or log in with your existing account.

- Type the asset name or choose it from the search bar which you wish to trade.

- Enter the position size.

- Choose “sell” or “buy” in the deal ticket.

- Confirm your trade.

Bottom line

In short, it is clear from the above guide that the three white soldier’s pattern acts as a bullish candlestick formation which is based on white and green candles. Each one of them is progressively higher in comparison with the first one. In general, with the three white soldiers’ pattern, it is clear that you are in the steady advance of buying any pressure, which is also the upcoming price reversal.