Economic events scheduled for today

02:30 | AUD Home Loans (MoM) | -3.5% -1.2%

Home Loans record the change in the number of new loans granted for owner-occupied homes. It is a leading indicator of demand in the housing market.

13:15 | CAD Housing Starts | 200K 201K

Housing starts measures the change in the annualized number of new residential buildings that began construction during the reported month. It is a leading indicator of strength in the housing sector.

13:30 | USD Import Price Index (MoM) | 0.8% 0.4%

The Import Price Index measures the change in the price of imported goods and services purchased domestically.

19:00 | USD Federal Budget Balance | -201.5B -232.0B

The Federal Budget Balance measures the difference in value between the federal government’s income and expenditure during the reported month. A positive number indicates a budget surplus; a negative number indicates a deficit.

Euro Dollar

Markets are shedding risk into the North American open as fears of an escalation in the European debt crisis are gripping markets. Most data in the last 12-hours has been respectable; however markets are ignoring the real economy side in favor of why yields are rising rapidly in the non-German bond markets.

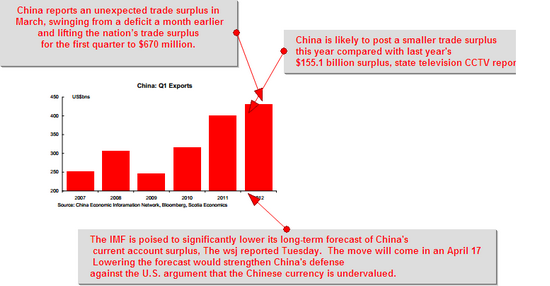

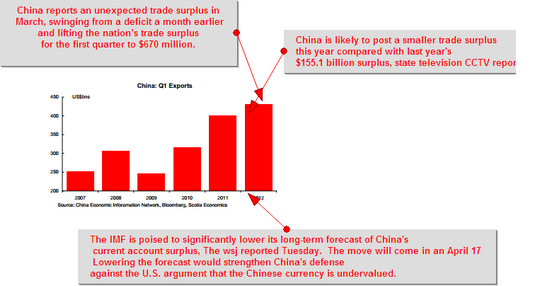

Trade data from China was mixed, with stronger exports than expected (+8.9%y/y and to$166bnbn) suggesting a soft landing but softer imports (+5.3% or $160bn) hinting that domestic demand is weaker than expected; while Germany released strong trade data and Fed Chair Bernanke’s speech proved a non-market event.

Strong German trade data (with exports increasing 1.6%m/m and an upward revision to the January data) has done little to support EUR. The currency is entering the NA having lost 0.3%, but still trading within yesterday’s range. Shifts in the European bond market, which suggest that contagion fears are once again the main driver, are a concern. The combination of the failure to meet fiscal targets and lower growth than expected is a dangerous one.

Most European 10-year yields are still below their November 2011 levels, but the pace of the shift higher is concerning (see top chart on page 1). This combined with German yields that are flirting with new lows is a clear reflection of rising market fears. For EUR this is a negative development, increasing the risk of a break below support at 1.30.

The Sterling Pound

The GBP is down 0.5% v. the USD and falling on the crosses as we approach the US session. Today’s session marks the first day that traders are officially back following the Easter holiday, with market participants confronting Friday’s weak US jobs data as well as the overnight release of mixed Chinese trade figures

Asian –Pacific Currency

The JPY is stronger, up 0.4% from yesterday’s close, as markets react to the BoJ’s decision to leave monetary policy unchanged. USDJPY continues to decline as it approaches 81.00 and it is now trading at levels not seen since early March. The Australian dollar is a quarter of a US cent higher after some promising news from the European Union leaders’ summit. The AUD was trading at 105.95 US cents, up from 105.67 cents on Monday.

China reported an unexpected trade surplus in March, swinging from a deficit a month earlier, and lifting the nation’s trade surplus for the first quarter to $670 million.

Gold

Gold closed higher on Tuesday, ending a choppy 1% ahead after getting safe-haven inflows while U.S. equities fell. Gold for June delivery advanced $16.80 to end at $1,660.70 an ounce on the Comex division of the New York Mercantile Exchange. Gold was trading lower all day, until investors looked for a safe haven on growing worries from the eurozone.

Crude Oil

Crude Oil fell in today’s session, extending losses into a second day as the dollar moved slightly higher and U.S. equities traded sharply lower. Crude lost $1.44, or 1.4%, to end at $101.02 a barrel. It had earlier traded as low as $101.27 a barrel. Investors moved from oil as demand continued to fall and on a forecast from Platt’s that this week’s inventory was going to show high supply. On April 13, Western and OPEC nations are set to meet with Iran to discuss the oil embargo, sanction and the Islamic Nations nuclear programs, reducing the geopolitical stress. Data released for March showed that there was more then ample supply being pumped by the GCC nations.