Hull Moving Average is a popular and well-known technical indicator that was developed by Alan Hull. This indicator helps improve weighted move averages for successful trading.

Among the different technical indicators available in the forex market, Hull MA is the one that can improve your trading skills and bring a significant change in forex trading. You can use it for various trading types, such as swing trading or scalping.

Hull moving average formula

The formula of Hull MA was uncovered by Alan Hull, where the developer has introduced a weighted moving average. The formula is:

Integer (Square Root (Period)) WMA [2 x Integer (Period/2) WMA (Price) – Period WMA (Price)]

WMA is the weighted moving average.

How can you use the hull moving average?

Now the main question is why you should use Hull MA! There have been some significant similarities between Hull MA and the rest of the variations. For example, you can use Hull Moving Average to:

- Close the price

- High

- Low

- Open

You are free to set the indicator at any period according to your preference. There are no scientific rules which you need to apply for using Hull MA. It is simple and easy to use.

What is a hull average crossover strategy?

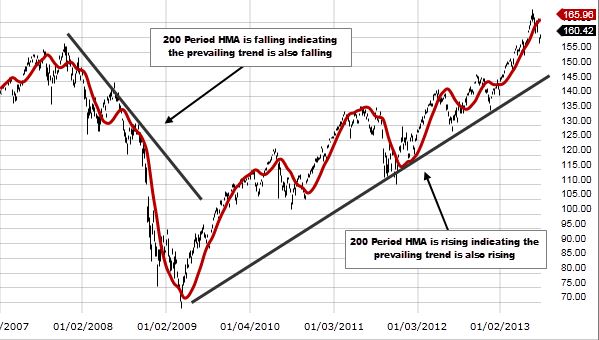

The Hull Moving Average Crossover Strategy is the actual beauty of this indicator! Hence, you can perform all those strategies which the cousin moving averages can easily perform. But it turns out to be more accurate in most cases.

The Hull Moving Average Crossover Strategy is the one that is simple to use and is easy to trade on. You just have to follow the main principle, which is all about following the trends similar to other crossover strategies.

In this strategy, you will be using two major hull moving averages for generating trading signals. With the HMA, you will find the potential signal as earlier. The core signal to follow in this strategy is:

- Buy

Once the faster HMA has crossed above, the slower HMA is equal to the buy signal.

- Sell

Once the faster Hull Moving Average crosses just below, the slower Hull Moving Average is equal to the sell signal

This is all! It is a super easy and effective strategy!

But what about getting the profit? Well, you can:

- Wait for the time till the HMAs will cross back over in the opposite way or,

- Take the profit to the nearest support and the resistance level or,

- Move the stop loss to start following the market direction.

But by throwing away the simple moving average for HMA would dramatically impact the whole strategy for betterment. So, all in all, it’s an effective strategy to work with to learn some easy trading strategies.

Bottom line

Summing up the Hull Moving Average, it is one such indicator that provides an accurate signal by simply eliminating the lag. Thus, in the end, it improves the emerging smoothness of the price activity.

By combining Hull MA with more technical indicators, more accurate signals can validate the price movement.