Using double bottom patterns is the first thing you need to check to spot a potential reversal in the Forex market. It is the most popular technical pattern among forex traders. As a result of a long decline, double bottoms are formed. Then, on your way up, you can use it to buy certain opportunities.

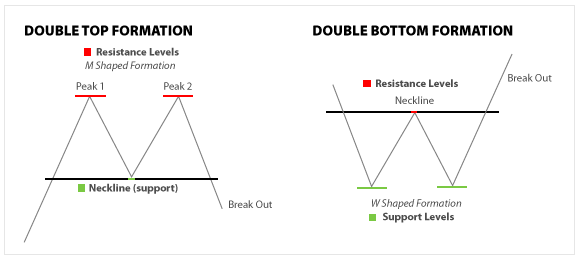

The double bottom pattern is characterized by two bottoms forming a key support level. Due to its extraordinary nature, this action pattern identifies certain levels in a market and price movements.

How to do trading with the double bottom?

When it comes to trading with double bottom chart patterns, there are a few basic rules that you should follow. Below are a few of the basic rules:

- Investigate the major market phase and determine when it is going up or down. Double bottoms form at the end of a downtrend. Therefore, the prior trend must also be down.

- A trader needs to determine if there is a formation of two rounding bottoms. In addition, it is critically important to consider the size of the bottoms.

- A trader should move into long positions once the price breaks out of neckline and resistance levels.

How is a double bottom helpful for traders?

With the help of a double bottom trading strategy, traders can detect any possible trend reversal within the trading market. Like the rest of the chart patterns and technical indicators, a double bottom pattern never indicates a trend reversal.

A trader should use such basic chart patterns with few other indicators. For example, you can use either volume for simply confirming the overall reversal before taking any action.

How can you identify a double bottom pattern?

Here is a tutorial to help you identify double bottom patterns on any chart:

- Identifying two distinct bottoms with similar heights and widths.

- The distance between the bottoms should not be too small. It hence depends on the timeframe.

- Confirm the neckline or the resistance price level.

- Support the double bottom bullish signal with the rest of the technical indicators. This includes moving averages and oscillators.

- Keep yourself up to date with upcoming trading trends.

It is highly used as a professional trading strategy by many traders due to its powerful reversal signal. You can hence use the demo account to get a better understanding of how this trading strategy works.

This trading strategy is the best platform for beginners and pro-traders to understand the price movements and forthcoming changes in the trading market to consider.

Bottom line

A double bottom trading strategy will help illustrate the approaching trend reversal over the chart pattern. Although it has a higher success rate, it is still necessary to use a protective stop loss.

When trading using double bottom chart pattern strategies, you should wait for certain breakouts. Even if the double bottom strategy does not work, you can trade breakout triangles. No matter what strategy you choose, forming a proper plan is necessary for all conditions.