Do you know what the Elliott Wave Theory is? As forex trading has become a more popular hobby or profession over the past decade, its popularity has grown significantly.

Technical analysis is the most commonly used tool by day traders to help them understand how to trade Forex.

To improve the effectiveness of technical analysis, many Forex traders rely on tools that are available for its improvement. Discover how to use Elliott Wave Forex Theory as part of your trading strategy by reading on.

Elliott wave theory basics

The Elliott wave method is a popular way to analyze financial market prices. This article will teach you about this method’s essence and central tenets. Besides identifying wave types in charts, you will also learn how to understand analysts’ predictions and make your own.

A certain amount of wave analysis is incorporated into the trading strategies of the most successful traders: some use it partially, some completely, and some use it for both trading decisions and market analysis. The stock market is not the only financial asset you can trade with it.

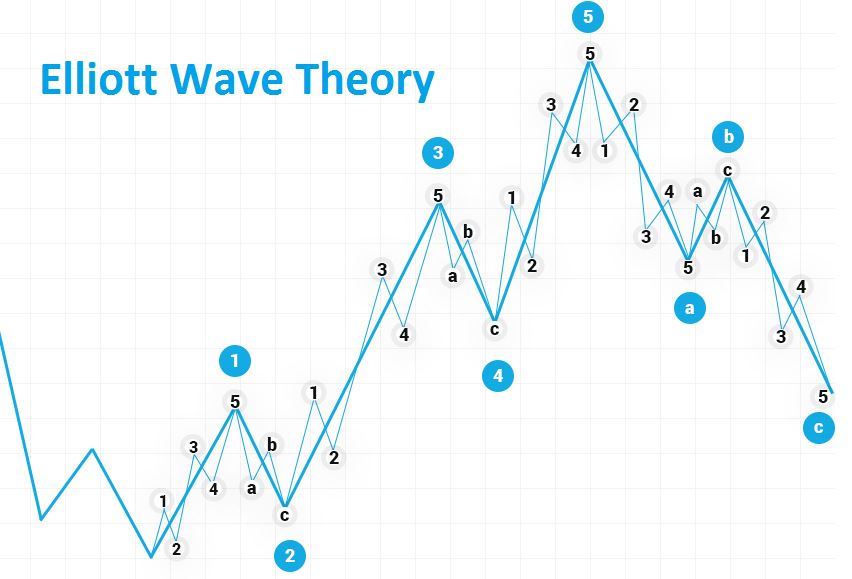

Markets are formed by crowds of interacting participants using this method. On the price chart, Elliott spotted that the crowd follows a predictable pattern and forms waves. Various types of waves can be found on the market.

To trade effectively, the trader must understand which type is developing and to what extent it has developed. Making the correct forecast and profitable trade will be easy if the trader succeeds.

Finding the sweet spot with Elliott waves

By using the Elliott Wave Theory, traders can predict how the market will move in the future and what portion of that movement they can capture. A trader who uses waves will have their preferred wave pattern, their sweet spot, so to speak, which allows them to keep track of all waves at all times without needing to keep track of them all.

Even though Elliott’s apprentices have difficulty distinguishing impulsive from corrective waves due to the variability of forms, Elliott also taught us another valuable lesson.

The market is much more likely to be in corrective mode than in impulse or sentiment mode, and the correction period can be highly unpredictable.

While waiting for confirmation that a trend has changed during a corrective pattern, patience is often exhausted. We must give corrective patterns time to develop to succeed in the market. Corrective patterns can be utilized in various ways, but discipline is necessary.

Is the Elliott wave forex theory accurate?

There is strong acceptance of Elliott’s waves in the trading community and intense criticism. Many traders consider this oscillator a valuable tool for analysis, but some ignore its use entirely.

To be clear, this is purely a theory that has not been proven to work. EW trading recommendations should only be used at your own risk. It is also vital to note that the EW oscillator is a well-known trading indicator. Because of this, an analysis called EW analysis has been developed.

Bottom line

It is best to practice extensively with the EW oscillator and analysis to see if it can enhance your trading strategy. If you are unfamiliar with them, you should try them out on a demo account as soon as possible. In the beginning, it might be hard for you to comprehend the waves, but with practice, you’ll get the hang of it. In the long run, you will see if EW can fit your trading style and if it can benefit you after becoming familiar with it in conjunction with your regular trading setup.