A pullback is mainly found when there is an up-trend.

It is because forex pairs need to rest during a rise. The same pattern also holds for downward trends, i.e., a short pullback occurs when there is a sharp decline.

The pullbacks provide an excellent pathway to enter the market, expecting the ongoing trend to continue.

However, we must be wary that although pullbacks make the price dip, there will be a rebound that we should look out for.

Dealing with pullbacks can be tricky, but understanding how they work can surely help. We will learn about pullbacks in the following paragraphs.

Find the Perfect Entry Price

First, you need to decide when to enter a pullback trade. Once a pullback occurs, keep your eyes peeled for a cross-verification.

These are areas where several supports or resistance cluster. They favor a particular rapid reversal and can move toward the primary trend. You can also enter a pullback when there are much less advantageous situations.

Do this by treating the support or resistance as bands of prices and not just thin lines – weigh the conflicting prices.

Pullback trades always run the danger of printing lower highs in uptrends and higher lows in downtrends, so keep an eye on gaps and short trading ranges for counter swings.

Swing Trade Target Using Support or Resistance

It is best to prepare a low-risk trade set up so that it is beneficial for every trader.

An all-rounder swing trade setup has three aspects that we need to know: an entry triggers a price, a stop-loss price, and the target price.

This target price is the last value of the three trade setup’s values.

Finding out the support or resistance areas is the simplest but highly accurate technique for setting swing trade targets for pullback setups.

You need to find a significant level of strong resistance (for bullish) swing trades, or you need to gather support for important short-sell trades.

Pullback Swing Trade Target Setting Strategy

Here are some of the strategies worth mentioning for pullback swing trading:

First pullback

This is precisely what the name suggests. It’s the first one following a trend shift. When the 10 SMA passes the 30 EMA, you’ve had a change in trend.

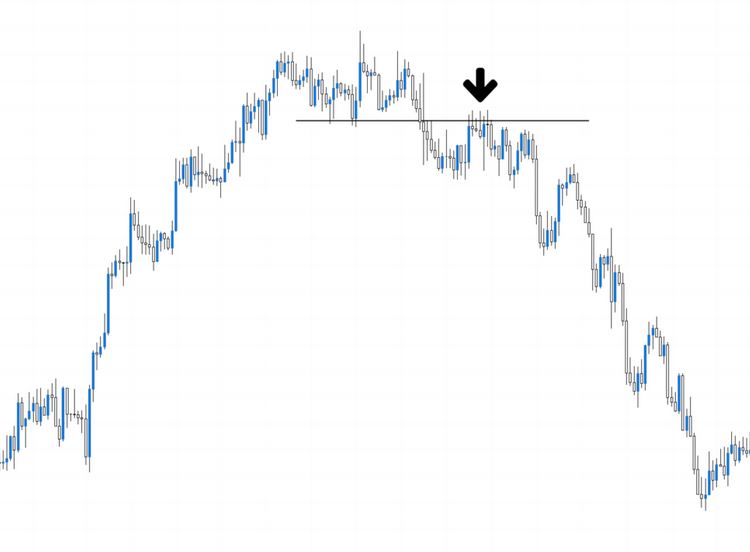

First pullback after a breakout

The first pullback after a breakout is an additional sort of pullback worth highlighting. If you’re watching a forex pair that’s been trading sideways or creating a basing pattern, and it quickly breaks out, you can buy the first dip after the breakout. This also provides a low-risk entrance into a stock that is expected to maintain its current path.

Bottom Line

Setting targets when trading pullbacks requires a lot of consideration.

It is a much more complex technique than it may seem from the surface. The main points to remember are that the easiest way to set a target when trading pullbacks is by finding out support or resistance areas. Past events in the forex have depicted pullbacks precisely.