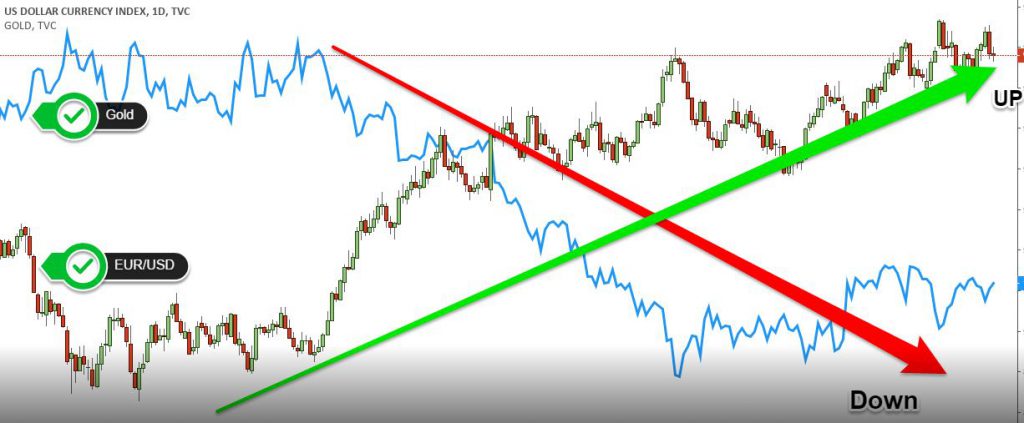

Investing in hedging is a strategy investors of all stripes use to protect their positions. Hedging usually involves establishing a second position with a negative correlation with the primary asset.

In other words, if the price of the primary asset moves negatively, the second position will experience complementary and opposite movements to counteract those losses.

The second pair of currencies can serve as a hedge for investors who don’t want to close a position. Using hedging to reduce risk at the expense of profits can be a valuable tool in forex trading to protect profits and prevent losses.

What are hedging forex strategies?

What does hedging in forex mean? Trading forex hedge strategies minimize losses by minimizing risks. You are free to open as many trades as you wish to change direction from your existing position. This offsets price fluctuations or unwanted exposure.

The forex market is subject to a wide range of influences. Many factors may affect inflation, interest rates, etc. To minimize risks, traders open various positions by moving assets from one to the other. To reduce risks, it is not necessary to eliminate them.

Why use forex hedging strategies?

Even on your first trade, you can be profitable with the hedge forex strategy. Most traders use this strategy because it reduces price fluctuations caused by fluctuations in exchange rates.

This strategy minimizes losses or limits risks to a specified amount, even if it does not guarantee risk elimination. By doing so, you can protect your interests against market volatility.

A trader employs this strategy primarily if they predict the market will favour their position. Rather than closing the trade entirely, they reverse it.

It will be a good strategy when you positively approach your speculations. It is risky to trade if you are not knowledgeable enough about market swings and are unwilling to take risks.

Advantages of hedging in forex

The benefits of forex hedging are similar to those of stock hedging, and it can be used effectively to stabilize accounts and open positions. The following are some of the benefits:

- It will help if you control the risk/reward ratio.

- The hedge functions as ballast and provides a valuable counterbalance when one position moves in the opposite direction of another.

- You can diversify your holdings more effectively.

- Its purpose is to reduce the risk of one variable or event causing loss across all of your open positions.

- Price swings can be prevented with this insurance policy.

- If volatility or sudden price swings occur, you can maintain your account balance by hedged positions.

- You can also create an income on your hedged positions until other positions have increased in value.

Potential disadvantages of hedging in forex

Even though hedging makes sense in many cases, it does come with significant risks, and it can nullify gains and profits if you do not use hedges properly. Hedging can cause the following disadvantages:

- Profit potential may be reduced.

- You can reduce your risk with a hedge, but your potential profit will also be reduced.

- When your initial open positions continue to produce profits, your hedged positions will likely lose value if they continue to earn profits.

- Hedging can be leveraged to your financial advantage if you have the expertise.

- It is often difficult for beginning forex traders to understand the market and execute hedges in a way that maximizes the value of hedges because creating and timing them is so complex.

Bottom line

Trading complex hedging strategies are not recommended until traders fully understand market swings and how to time trades to make the most of volatility. Losses can accumulate rapidly if timing and pairing decisions are poor. Experienced traders can use Forex hedges to protect profits and continue creating revenue through their knowledge of market swings and the factors affecting these price movements.