The abandoned baby candlestick pattern is a reversal pattern with three bars. It resembles the morning and evening star formations and denotes a reversal following a steep climb or fall.

How can you identify the pattern?

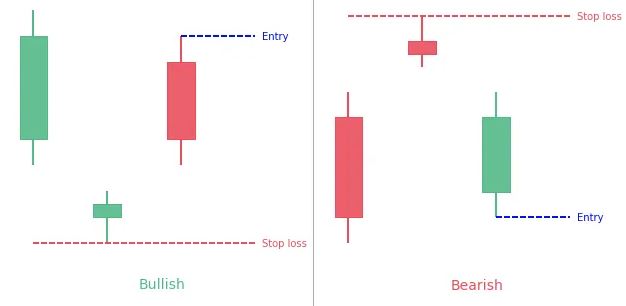

Abandoned baby consists of a bullish and bearish pattern.

The bullish abandoned baby is a form of candlestick pattern that traders use to indicate a downtrend reversal. It is made up of three price bars and appears during a decline.

The first candle is a large down candle, followed by a doji candle that gaps below it. Finally, the second candle opens higher than the doji and pushes forcefully upward.

The bearish abandoned baby is a candlestick pattern made up of three candles: one with rising prices, one with stable prices, and one with dropping prices. When a doji is preceded by a gap between its low price and the preceding candlestick, this pattern pops us.

A large bullish candlestick with little shadows followed the previous candlestick. A gap exists between the lowest price of the doji and the highest price of the next candle.

A large bearish candlestick with little shadows is the next candlestick. The doji candle becomes important for traders to spot a bearish reversal of a bullish trend in this pattern.

Similar patterns like an abandoned baby

The evening star and morning star are similar to both the bullish and bearish abandoned baby patterns.

The appearance of a doji candle with a gap on either side distinguishes the abandoned baby patterns.

The second candle in the evening and morning star formations does not have to be a doji or have gaps on either side.

How can you apply the abandoned baby in a trading strategy?

Traders look for bullish/bearish abandoned baby patterns to indicate when a downturn or upswing may be coming to an end. The pattern is unique because price fluctuations must match precise parameters to form it.

The concept behind trading the bullish pattern is that the price has decreased aggressively and has now seen another significant sell-off.

The price then forms a doji, indicating that selling is leveling off because the doji’s open and closing prices are almost equal.

The price has been drifting lower in the bearish pattern, and buyers have resumed their buying. It creates a doji and suggests a pattern reversal.

At the top or bottom of a trend reversal, the abandoned baby indicates indecision. There is generally a lot of activity between buyers and sellers within the candle.

When using the approach, keep in mind that the doji may not gap below the first candle’s close but instead open around the previous close and stay there.

Before the price begins to go upward, there may be two or three dojis. Some traders might accept this because the pattern still shows a decrease, a leveling out, and a rapid climb.

Bottom line

The advantage of the abandoned baby candlestick pattern is that you may trade it right away if you detect it on the chart! Because the pattern produces fewer false signals, it is not essential to apply other trade indicators to validate the signal. However, it rarely occurs on the chart.