When a currency’s forward price exceeds its spot price, it is said to have a forward premium. A rising domestic exchange rate against other currencies indicates the market. When the exchange rate increases, the currency’s value decreases, creating confusion.

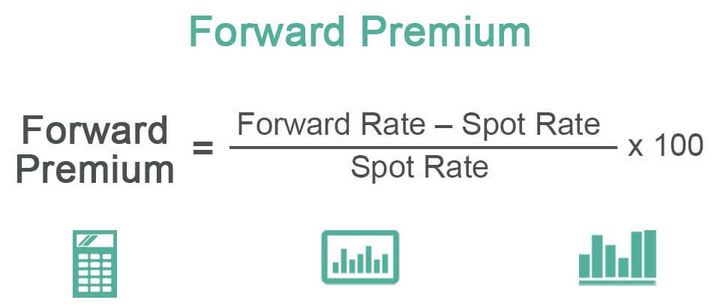

Forward premium formula

Formula = (The Future Exchange Rate – The Spot Exchange Rate) / The Spot Exchange Rate * 360 / No. Of Days in the Period

For example, consider an exchange rate of $1.1365 between U.S. dollars and euros. Domestic interest rates are 5%, and foreign interest rates are 4.75%. By plugging these values into the equation, we get the following results: F = $1.1365 x (1.05 / 1.0475) = $1.1392. Here, it represents a forward premium.

How does a forward premium in Forex trading work?

Forward contracts determine the price you will pay to acquire an asset at a later date. When investors expect a currency to rise in value in the future, they will pay a premium to acquire it now. A forward premium can be described as this.

Currency appreciation will result in successful investment if the premium paid exceeds the currency’s appreciation. A forward premium and discount can be estimated using the formula below:

Forward Premium = ((Forward Rate – Spot Rate) / Spot Rate) *100

Economists and researchers also often express forward premiums or discounts regarding their annual value. Calculate forward premiums annually by multiplying the formula above by the contract’s duration.

Annualized Forward Premium = ((Forward Rate – Spot Rate) / Spot Rate) * (360/ Duration of the forward contract) *100

When determining market trends and making investment decisions, investors can use a forward premium as an indicator. A forward premium may indicate a lower interest rate in the domestic currency. On the other hand, a forward discount may indicate that interest rates are likely to rise in the domestic currency.

Spot and forward rates are needed to determine whether a forward premium exists. Our spot rate is calculated automatically for a given currency based on the current exchange rate.

To begin with, we must calculate the forward rate. Using the spot rate and dividing it by the international exchange rate, this value can be calculated.

What it means for individual investors?

Investors can use the forward premium/discount formula in the forex market to predict future currency pair price movements.

To put it simply, a forward forex contract determines how much you would have to pay today to acquire a currency in the future. You can use your forward premium or discount to determine what direction currency movement might take.

Whether a forward premium or discount is applied, the forward rate does not guarantee a parallel movement in the currency pair price. While it’s an indicator that can assist investors in making investment decisions in the forex market, it works best along with other technical analysis indicators.

Bottom line

A forward premium occurs when a currency’s forecasted future price exceeds its spot price. Forward premiums usually refer to the difference between spot rates and forward rates. Negative forward premiums are equivalent to discounts.