If you’re new to trading (or even if you are), you might be wondering how much time you should spend “in front of the screens.”

There’s a lot of chatter in the media about “day trading,” For an ambitious home-based trader, this is frequently the image that springs to mind.

Day trading entails spending long hours in front of live charts, making several real-time trading choices.

It necessitates daily monitoring and intra-day trades that must be fine-tuned to ensure that spread and transaction expenses do not eat away at earnings.

Day trading necessitates a significant time investment.

In addition, it’s tough to execute if you’re attempting to trade while working full-time or if other obligations conflict with market session times.

So, is there another trading strategy method that necessitates less time spent in front of screens?

One that helps you to better manage your time between trading and other obligations? One in which your outcomes can be just as excellent, if not better, with fewer (perhaps much fewer) trades?

Yes, there is; it’s known as swing trading.

Elements in swing trading

Swing trading does not require you to monitor the charts to execute intraday deals throughout the day. Instead, you arrange for deals that will take more than a day (or perhaps weeks) to complete.

Swing trading seeks to capitalize on sustained medium-term swings within longer-term trends.

It is a trading strategy between short-term (intra-day) and long-term (position-trading).

Swing trading and long-term trading methods are not the same thing. It is often used by institutional investors, who generally hold their investments for a lengthy time.

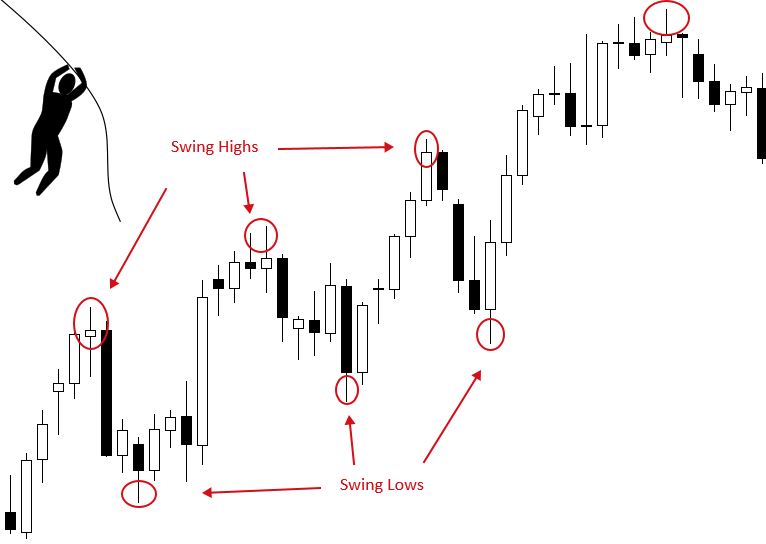

Swing trading looks for swings within a medium-term pattern and enters only when there appears to be a strong probability of success.

In an upswing, for example, you should buy at swing lows. Short at swing highs, on the other hand, to profit from brief countertrends.

The benefits of swing trading

Swing trading offers the following benefits:

- It’s an active trading style, but it’s less stressful than day trading—watching charts for hours a day and attempting to make minute-by-minute trade choices may be taxing. Still, swing trading involves fewer trade decisions, giving you more time for analysis and evaluation.

- It makes the most of screen time—the “return on time spent in front of the screen with swing trading is substantially higher than with day trading.

- It offers time flexibility—you can have a day job as a swing trader (since you don’t have to monitor the screens for hours every day) while still managing other time responsibilities in your life (you can choose when you wish to do your analysis and preparation based on your daily schedule)

- Swing trading is a strategy that falls between day trading and longer-term position trading.

- Compared to day trading, it provides the primary benefits of time flexibility and lower stress, because it needs less time in front of trading displays.

- Like other sorts of trading, Swing trading is difficult and necessitates a prudent, tried-and-true strategy that delivers profit potential.

Bottom line

Some traders choose a long-term perspective, while others produce additional trading chances daily. Swing trading enables this by watching market fluctuations rather than merely sitting back and hoping for things to go your way.