A three-line strike is a set of candlesticks that consists of three bars in the trend’s direction, followed by a final candle that pulls back to the start point.

How can you identify the three-line strike?

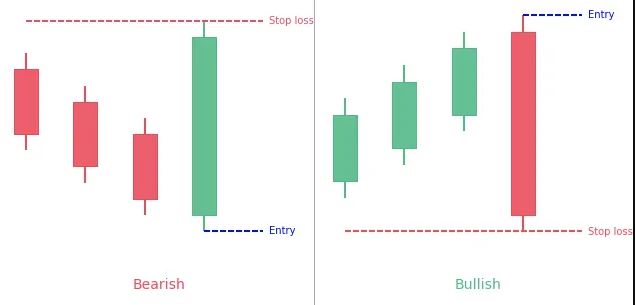

Four candles make for a bullish three-line strike. The first three of these are bullish, while the fourth is bearish. Thus, it consists of three solid bullish candles that end higher and are followed by a striking candle.

The strike candlestick is bearish and starts at or above the third candle but ends at or below the first candle’s open.

In a bearish trend, a bearish three-line strike is a four-candle continuation pattern that appears. The first three candles are bearish, while the last candle is bullish and closes above the prior three candles’ highest close.

Three dominant falling candles close at successively lower levels, followed by a single bullish strike candle. The strike candle should open at or below the third candle’s close and close higher than the first candle’s open.

Three bearish candles and one large bullish candle, all in a downtrend, make up the pattern.

Each candlestick has a lower low and a close that is close to the open’s low. The fourth candlestick begins much lower but reverses into a wide range and closes above the series’ initial high. The bottom of the fourth candlestick is likewise marked by the open’s high.

How to apply a three-line strike pattern strategy?

Because the pattern is generated during a trend, identifying a trend and identifying the three bearish or bullish candles is important.

In forex charts, three-line strikes are uncommon. As a result, the strike candle’s low can retrace down to at least the first candle’s open as an alternate scenario in a bullish pattern.

The high of the strike candle should retrace up to at least the opening of the first candle in the bearish three-line strike.

Confirm that the first three candles have entire bodies and are at least of average size for a good pattern. They should resemble a staircase in appearance. This can make three-line strike like a Doji or smaller candlestick patterns. However, they are not reliable.

A bullish three-line strike can be thought of as an extension of a group of three white soldiers, while a bearish three-line strike can be thought of as an extension of a group of three black crows.

When the bottom of the red or black strike candle goes below the opening of the first candle, a buy signal is verified in the bullish pattern. This creates an excellent entry opportunity for a trend purchase.

The high of the strike candle does not reach the opening of the first candle in the bearish three-line strike, but it is near enough to be considered a bearish continuation.

Bottom line

When looking at the charts, make sure the four candles meet all of the conditions mentioned above.

Three line strike is rare, so you need to combine it with indicators to confirm the signal.