2013-05-09 07:00 GMT

EUR/USD notches a solid day of gains as ‘risk on’ mentality continues

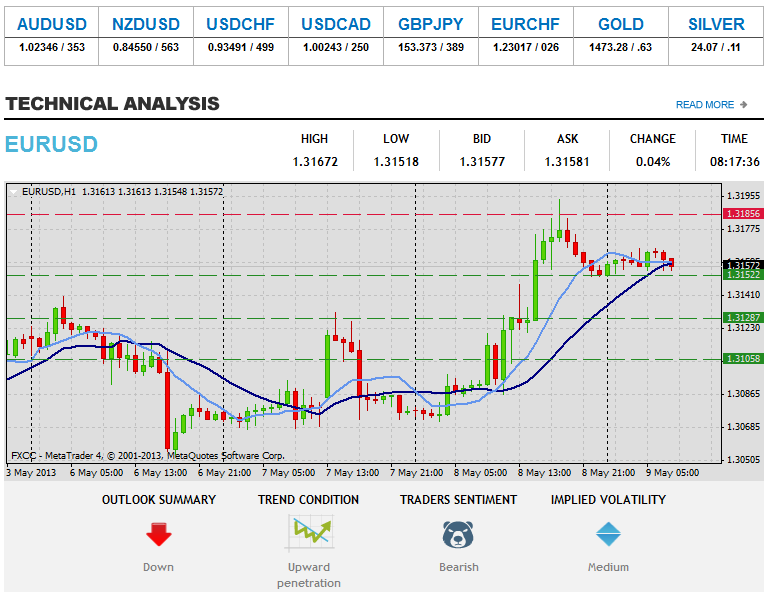

In a day where risk assets were primarily well bid across the board, the Euro was able to notch some decent gains, finishing up 81 pips at 1.3159. The initial catalyst which seemed to help push the pair higher was the German Industrial Production (MoM) release which came in at 1.2% actual vs. -0.1% forecast. According to analysts at TD Securities, “In Europe, a solid German industrial production release has boosted the EUR. Not significantly though, as the very well established range that has held since early April remains firmly intact. EUR focus remains on the evolving ECB message, which as we heard last week remains open to another rate cut. They have not signaled any balance sheet expanding programs, however, which overall could leave the EUR well supported.”

The German data also seemed to give a boost to both commodities and equities, with oil notching its’ highest close since late March and the S&P 500 closing at a new all time high of 1632.59. The recent behavior of the EUR/USD is beyond confusing as it appears to follow risk assets some days and others have no correlation to outside markets at all. Although it must be noted, the EUR does continue to outperform the commodity currencies such as the AUD and NZD. – FXstreet.com

FOREX ECONOMIC CALENDAR

2013-05-09 11:00 GMT

UK.BoE Asset Purchase Facility

2013-05-09 11:00 GMT

UK.BoE Interest Rate Decision (May 9)

2013-05-09 12:30 GMT

US.Initial Jobless Claims (May 3)

2013-05-09 14:00 GMT

UK.NIESR GDP Estimate (3M) (Apr)

FOREX NEWS

2013-05-09 03:11 GMT

GBP/USD continues to consolidate ahead BOE Rate Decision

2013-05-09 01:19 GMT

Aussie rockets higher after AUD jobs data crushes estimates

2013-05-09 01:19 GMT

EUR/JPY ready for the next leg up?

2013-05-08 23:42 GMT

AUD/JPY finishes slightly lower after narrow range day

MARKET ANALYSIS – Intraday Analysis

Upwards scenario: Instrument stabilized after the gains provided yesterday. Penetration above the resistive structure at 1.3185 (R1) might encourage protective orders execution and drive market price towards to the next resistive means at 1.3206 (R2) and 1.3226 (R3). Downwards scenario: On a slightly longer term we expect pullback formation. Risk of market depreciation is seen below the next support level at 1.3152 (S1). Clearance here would suggest lower targets at 1.3128 (S2) and 1.3105 (S3) in potential.

Resistance Levels: 1.3185, 1.3206, 1.3226

Support Levels: 1.3152, 1.3128, 1.3105

Upwards scenario: Pair has settled sideways formation on the hourly timeframe. However potential to move higher is seen above the resistance level at 1.5549 (R1) mark. Loss here would suggest next intraday targets at 1.5565 (R2) and 1.5581 (R3). Downwards scenario: Possible downside expansion would attack our support levels at 1.5517(S2) and 1.5498 (S3). However prior reaching our targets, market should manage to overcome the resistive structure at 1.5533 (S1).

Resistance Levels: 1.5549, 1.5565, 1.5581

Support Levels: 1.5533, 1.5517, 1.5498

Upwards scenario: USD/JPY tested negative side the past days, however break above the resistance at 99.00 (R1) is liable to stimulate bullish pressure and validate next targets at 99.14 (R2) and 99.27 (R3). Downwards scenario: Loss of our support level at 96.68 (S1) would open road for a market decline towards to our next target at 98.57 (S2). Any further price weakening would then be limited to final support for today at 98.40 (S3).

Resistance Levels: 99.00, 99.14, 99.27

Support Levels: 98.68, 98.57, 98.40