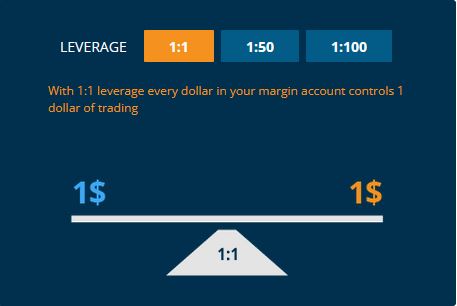

Leverage refers to the proportion of your deposit to the loan amount. For example, with a deposit of $100, those who wish to make a deal with a lot of 10,000 can do so. This time, the leverage is 100 to 1. A lot of 5,000 will have a leverage of 1 to 50, etc. leverage up to 200 is considered maximum.

Essentially, leverage is an increase in investment income achieved through borrowing capital. Rokers can “lend” capital to trades which, in turn, can open more significant positions if they had a more considerable amount of money on their trading account. However, this also implies that the trader will suffer losses in the same proportion that he would have if he had a much larger capital.

Leverage example

Check out this simple example. In your capacity as a novice investor, you have decided not to invest more than $1000 in operations with assets in the stock market. And suddenly, you come up with a good plan, and you need $20,000 to deal with your portfolio.

A leverage of 1:20 can be obtained by borrowing the missing funds from your broker. A broker is responsible for protecting his money, and since he is an automated system, he sets a threshold for losing money on the transaction, equal to the value of our account, which is $1000.

Leverage levels that are lower allow for a more comprehensive but reasonable stop to be set on each trade and avoid a higher capital loss. When the highly leveraged transaction goes against you, you can quickly lose your entire trading account as the more significant lot sizes cause more considerable losses. It’s important to remember that leverage can be personalized to meet the need of each trader.

The leverage is automatically set when you select a lot of o work with.

Leverage benefits

- Capital increase for the transaction – if you are at the right place at the right time, you can make profitable and lucrative transactions without having the needed funds.

- No commission for the use of borrowed funds – you won’t have to pay a commission; you’ll have to pay the broker the amount of your profit or if you lose, your losses.

- Even without owning a large amount of capital, traders can participate in capital-intensive markets.

- Trading at lower asset prices offers a technical opportunity.

Leverage disadvantages

- By increasing the transaction amount, there is a risk that the deposit and funds in the account will be lost. In other words, more financial leverage does not necessarily mean higher risk!

- In every transaction, only three factors influence risk: the quality f the asset, the market situation, and the trader’s trading strategy. The use of stop losses is a great way to minimize the risk.

Bottom line

As soon as you learn how to manage leverage, you don’t have to be afraid of it. Leverage is only appropriate if you are not actively involved with your trades. In any other case, leverage can be managed effectively and very profitably. When appropriately used, leverage is similar to any sharp instrument. Once you master this, you no longer have anything to worry about.