End of Day trading is simply the practice of trading when the markets close. Stocks and futures markets open and close according to regular business hours. With Forex, It’s a little different because this market works 24 hours, so it doesn’t really close. What happens is that local markets like London, Asia, and America do close, reducing the liquidity of pairs.

What End of a Day trading in Forex means is that you will make your operations after the close of the local session that affects the pair you are trading.

After the end of the day, traders who apply End of day trading can quietly sit and study how the market behaved during the day and set their strategy to trade the next day.

This type of trading requires much less time in front of the computer and allows you to avoid all the volatility of day trading.

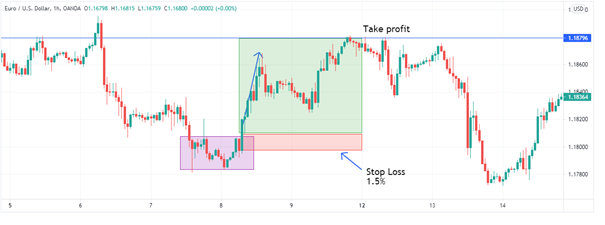

Above, we can see how markets are less volatile after the closing time. This gives us time to read the situation and act.

Advantages

Less trading time

This is the more obvious advantage of End of Day trading. The trader who applies this type of trading just needs to spend a few minutes or hours studying how the price changed during the day. Then, he can adjust its strategy and then set limits orders for the next day. He will only revisit the market at the end of the next day to see how his strategy works and make the proper adjustments.

Keeping your job

Many traders dream of quitting their jobs and live on trading. This is an achievable goal, but as with most things, being a good trader take time and practice. So, it’s never a good idea to depend only on trading to live when you are starting. End of day trading allows you to trade without quitting your job because it only requires a few hours a day at the end of the day.

Stronger signal and greater profit.

By trading this way, you can reduce the market noise during the day, which allows you to get stronger signals from a longer timeframe. Also, it is well known that trading longer timeframes will not only give you stronger signals but also greater profits. So, if you apply a good strategy, you’ll get greater profits with fewer risks.

Disadvantages

Overnight developments

The major advantage of this type of trading is also its major disadvantage. Forex markets don’t close. So, although its volume is lower than in business hours, it’s still running. This could lead to missing overnight developments that could be against us.

Risk management

In the same line, when trading this way, risk management is reduced because the trader is not in front of the screen supervising the market.

Best End of day Strategy

The most recommended strategy to operate at the end of the day is the breakout.

First, we need to understand what a breakout is.

The Forex market contracts in low volatile periods and expands in trends. To make a profit out of this behaviour you want to enter at the right moment. The way to operate this strategy is:

1) Wait for a low volatile range to form.

2) Enter the trade on the first move outside the range.

3) Set stop loss between 0.5% and 2.0%. Many traders recommend 1.5%

4) Set your take profit on the next high. You do this by reviewing the weekly chart to find the nearest support and resistance level.

Bottom line

End of day trading is one of the best options for part-time traders. It’s a set and forget way of trading that allows you to keep your job while you make your way in the trading world. The major advantages of this type of trading are closely related to the disadvantages. They are two sides of the same coin. However, this type of trading is a great option for those traders looking for less stress when trading and more free time for themself.