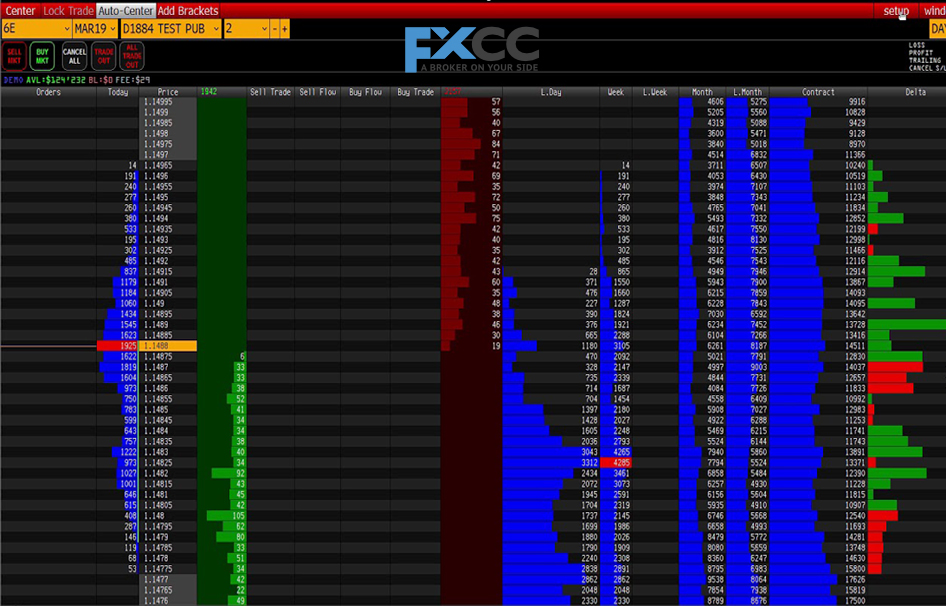

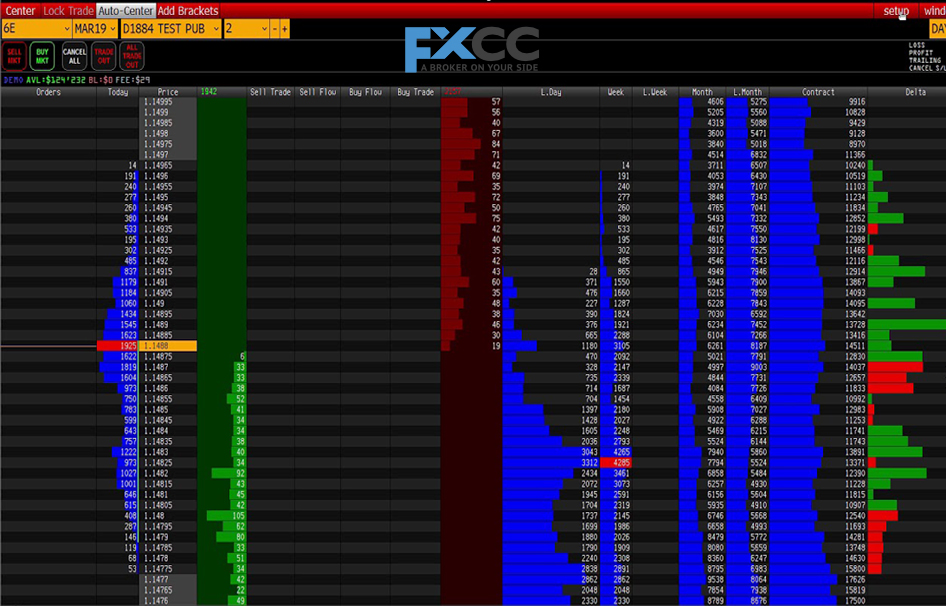

DOM or depth of the market is the number of buy and sell orders for a currency pair at different prices.

It provides an indication of liquidity and depth for a currency pair in the forex market. DOM is also synonymous with the order book as it shows pending orders for the currency prices.

The DOM is higher when the buy and sell orders are higher for each currency pair.

DOM can display the following orders:

1. Market order: These orders are executed instantly at the best price from Bid and Ask (depending on the direction of the order).

2. Limit order: These orders are executed as the price moves and are executed at a predetermined price.

3. Conditional order: These orders appear in the forex market on certain conditions, for example, reaching a certain price at the quote.

The importance of DOM

Almost all forex market professionals will tell you; DOM is a valuable tool when conducting short-term trades. They will also tell you that this is a much more useful tool than typical technical graphics.

You can easily see several contracts at each price, who is currently driving the market, buyers or sellers, or if the market is balanced or merely inactive.

Who needs DOM?

The depth of the market works best for a small trader. The idea for small traders is to wait for large contracts to enter and get as close to them as possible, and then move on to the “backs” of more significant players.

In the end, prices are carried by substantial volumes of orders, which inevitably come from large players.

The best strategy for small traders is to follow the actions of a significant player who can change the market’s movement at any time.

Advantages of DOM trading

- It displays incoming orders for transactions whose execution will not be affected by non-pricing (that is, orders are “close to the market”).

- It shows where the largest volumes are located.

- It helps analyze liquidity imbalances. In other words, it shows the level of an excess of demand over supply and vice versa.

Disadvantages of DOM trading

For DOM to work, a trader must understand whether he has enough capital and leverage to influence the price so that he can reverse the deal at the changed prices.

For example, there are 100 sellers on market willing to sell 1,000 units of an asset for a price in the range of 30-40 dollars.

If you buy 50 units, then by your volume, you will not have any influence on the market, but if you decide to buy 500 units at once, then the remaining sellers, seeing increased demand, will raise the price.

It is crucial to keep in mind that since there is no central market in forex, the data presented in the back of the market will be logically limited by the broker who offers the depth of market feature.

This is why many traders who prefer DOM trading trade with an ECN broker as the ECN brokerage firms send all orders to the marketplace with banks and other financial institutions.

New to Forex trading? Don’t miss these beginner guides from FXCC.

– Learn Forex Trading step by step

– How to read Forex charts

– What is spread in Forex Trading?

– What is a Pip in Forex?

– Low Spread Forex Broker

– What is Forex Leverage

– Forex Deposit Methods