Who in the world doesn’t aspire to be successful all the time? However, the question arises whether it is possible for good fortune to always triumph. Unfortunately, the answer is “No.”

For a trader, there are frequent moments of loss or drawdowns. Even the best poker players have to confront defeat.

The turbulent economic circumstances have experts predicting a rough period. In this state of affairs, you must understand what drawdowns are.

Here we are going to jot down everything you should know. We’ll also familiarize you with ways to cater drawdowns and strengthen your portfolio.

What is a forex drawdown?

In the context of forex, drawdown refers to a decrease in your portfolio’s equity. A forex drawdown is unavoidable, regardless of the trading strategies you employ.

A drawdown occurs when your cumulative capital in the forex market reduces. But trust me, this isn’t the right time to give up on trading. A downturn can also be part of a successful venture in the long haul.

But before that, you ought to determine whether you can handle the downturn. You’ll also have to analyze if your pair will regain profitability or not.

Now let’s delve deeper into it and see how to calculate and assess your drawdown.

Calculation of forex drawdown

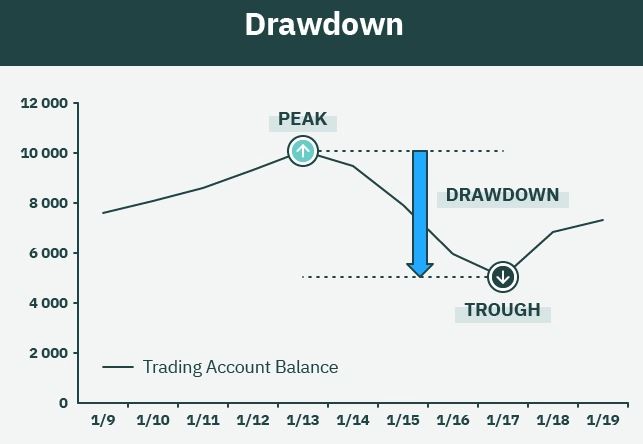

The first step of this process is identifying a capital peak and a trough. We mean the highest point by the peak, and the trough implies the lowest point.

To calculate the drawdown, you must subtract the trough from the peak. Typically, this is a percent of your entire portfolio.

To better understand the implications of your calculations, you need to know the types of drawdowns.

Types of drawdowns

In forex, there are several types of drawdown.

Absolute Drawdown

Absolute drawdown makes use of your startup investment as a baseline. It is the difference between the starting payment and the point when it is the lowest.

Maximum drawdown

This method calculates your loss by using your equity peak rather than your initial deposit. As a result, the maximum drawdown is the greatest decrement in your account balance from peak to trough.

Relative drawdown

The maximum drawdown percentage is another name for relative drawdown. First, divide your maximum decline by its peak point. Then multiply by one hundred to determine your relative drawdown.

Now, we’ll let you know about the importance of drawdowns.

Significance of drawdowns

Though drawdowns are not pleasant, they give sufficient information about your portfolio. They may also help you determine whether or not your trade will be profitable in the long run.

If you want to know about the most favorable time for the trade, drawdowns might help. They also give you an idea of your sustainability in the market. This is because large downturns can weaken your position.

You can deal with a downturn by re-aligning your system or using correct mitigation strategies.

Bottom line

When you experience a major drawdown, you may not be able to break even. But, at least you can alleviate any loss and hold yourself from having to dig a deeper hole.