Trading in the markets involves placing pending orders. They are price levels that indicate the purchase or sale of an asset at some point in the future. Upon reaching a certain price level, the order will be executed.

The “Buy Limit” and the “Sell Limit” are two other pending orders traders commonly place along with Buy Stop and Sell Stop. When traders wish to buy their assets in the future, they set a Buy Limit.

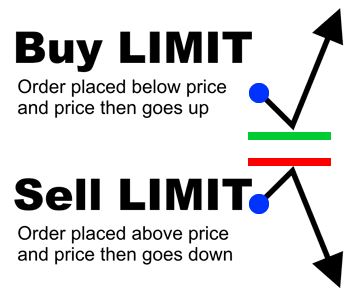

A Buy Limit, however, always implies a predetermined price lower than the current market price, unlike a Buy Stop. A sell Limit is also applicable when a trader wishes to sell an asset in the future.

In most cases, the Sell Limit will be higher than the current market price. Sell Limits are set by traders anticipating that their asset price will decline after rallying (spiking). Buy Limits predict that they will rise after an asset’s price declines.

How do Buy Limit and Sell Limit orders work?

You can use entry orders like this to:

Control price: When you define a price level to execute a trade, you don’t have to monitor the market (consider synonym watching) constantly.

Save time: Your order will wait for you so that you can concentrate on other things.

Save money: You can get good (use a more precise adjective) prices by executing at a lower price.

Key Differences

A buy-limit order differs from a sell-stop order in that it relies on the order type. The difference between a limit and a stop order is crucial to understanding these orders. A limit order specifies a price and executes the trade at that price.

An order to buy at a limited price or below will be executed. An order to sell at a limit price or higher will be executed at that price. You can specify a price with a limit order.

Stop orders include specific parameters for triggering trades. Stocks will be executed at their next market price once they reach the stop price. Due to its limitations in price entry, stop orders commonly serve for margin trading and hedging.

As a result, buy stops must usually be above the current market price, whereas sell stops must be below. When a buy-stop order reaches the buy-stop price parameter, it will be executed at the next available market price.

To execute a sell stop, the next available market price would have to reach before the sell stop takes effect. A buy stop closes out a short stock position, while a sell stop stops a loss on a short position.

How does a Limit Order work in forex?

You have the order to buy EURUSD at 1.1009 if the price is at 1.1000. It will not be possible to place an order if the price does not reach 1.1009 or lower. A Sell Limit prevents the order from being filled until the price reaches 1.1009.

What if I want to cancel my Buy or Sell Limit order?

In the same way, you can cancel a standing order, and sell or buy limits can be canceled at any time if it hasn’t yet arrived.

Do Buy and Sell Limit Orders execute at the same time?

You will receive a Buy Limit order if the Ask Price exceeds your limit price. Sell Limit Orders can only be executed if the price is above or equal to the limit price.

Bottom line

A firm understanding of each type of order will help you determine how you will enter the market (trade or fade) and how you will exit the market (profit/loss). It is common to place market, stop, and limit orders. If you do not execute orders correctly, you may lose money.