All participants in the foreign exchange market want to protect their profits and maximise their gains.

Stop-loss orders are widely recognised as a reliable method of saving capital, particularly for novice traders. First, let’s define stop-loss orders in the foreign exchange market.

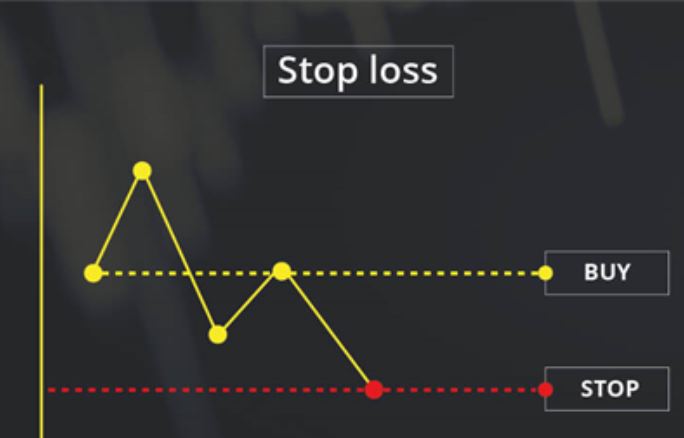

A stop-loss order is a common strategy to limit financial loss in foreign exchange trading. Stop market orders are also known as stop orders.

If this instruction is followed, a losing transaction will be closed. Therefore, it instructs the trader’s broker or trading firm to execute a trade when the market price falls below a specified threshold.

Even while no forex trader ever hopes to have a trade go against them, it is essential to do what you can to limit your exposure to loss.

How do stop orders work?

You should be familiar with stop orders, often known as stop-loss orders. Limit orders, which are used to make money, and stop orders, which are used to prevent losses, operate in distinct ways.

Check out these examples: Put a stop loss order on any USD/GBP trades below 1.3100 and purchase GBP/USD around 1.3110.

If no one is willing to place your final sell order at 1.3100, your stop will not be appropriately set. An essential economic report may be scheduled for release at that time.

Should I use a stop-loss order?

A successful forex trader knows where to unload the offending currency pair if a deal goes south. They also know the best places to cover their short positions in exchange pairs.

A stop-loss is a safety net to guarantee the deal goes through as expected. Take-profit orders, like limit orders, ensure a profitable trade is closed at the optimal time.

You don’t have to constantly keep an eye on the price with a stop-loss order because you know there is an order ready to cut all your losses. It’s encouraging that most people who enter the trading industry do so as a side hustle at first.

Stop-loss instructions for foreign exchange trading

One of the most crucial skills for beginning traders to acquire is the ability to place a stop-loss order. Your stop loss level depends on your risk tolerance and the size of your open positions.

Stop-loss trading strategies are the most effective technique for evaluating different trading approaches.

- Input the SL order, or stop loss. First, determine the actual price to prove whether the trading hypothesis is correct.

- The second step is to enter a TP (take-profit) order. The market will adjust to your predicted price level if you are correct.

- Third, your potential loss equals the spread (in pips) between your entry and stop-loss prices.

- The maximum percentage of your trading account that should be at risk per trade is 2%. If you risk only $500 for each trade, you can trade five lots and set your stop loss at 50 pips.

Bottom line

Therefore, there is typically just one purpose for placing stop-loss orders. It reduces risk by putting a cap on potential damage. In a nutshell, stop-loss orders are strongly recommended for all trades. Because of this, they won’t have to worry about losing as much money.