In the realm of technical analysis, the Zig Zag Indicator stands out as a versatile tool for traders seeking to filter out market noise and identify meaningful trends. By focusing on significant price movements, the Zig Zag Indicator helps traders spot reversals, trends, and corrections with greater clarity. This article delves into advanced trading techniques using the Zig Zag Indicator, offering insights on how to enhance your trading strategy and make more informed decisions.

Understanding the Zig Zag Indicator

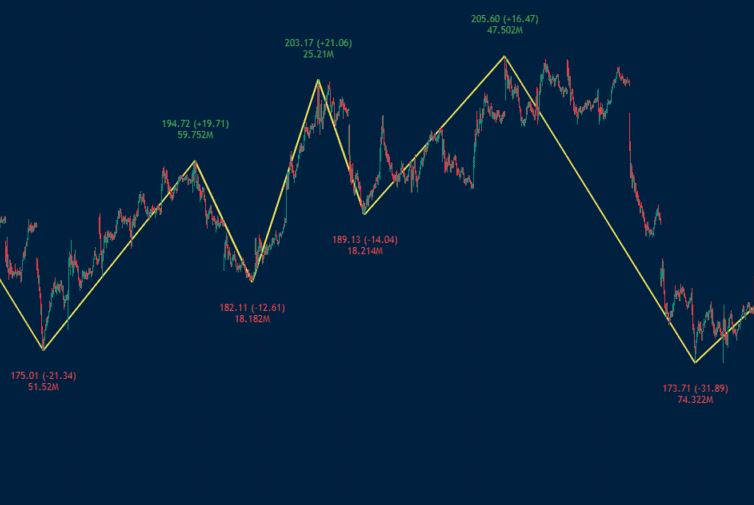

Before diving into advanced techniques, it’s crucial to grasp the basics of the Zig Zag Indicator. This tool, available on most trading platforms, plots lines on a price chart to highlight significant price changes. The indicator works by setting a predetermined percentage move (usually 5% or higher), and it only draws lines when the price change exceeds this threshold. By doing so, the Zig Zag Indicator filters out minor fluctuations and emphasizes the primary trend direction.

Setting Up the Zig Zag Indicator

To effectively use the Zig Zag Indicator, you need to configure it appropriately. The most common parameter to adjust is the percentage move threshold, which determines the sensitivity of the indicator. A lower percentage (e.g., 3%) makes the indicator more responsive to price changes, while a higher percentage (e.g., 10%) filters out more noise but may miss some smaller trends.

- Choosing the Right Time Frame: Selecting the appropriate time frame is dependent on your specific trading style and goals. For day traders, shorter time frames like 5-minute or 15-minute charts are more relevant, while swing traders might prefer daily or weekly charts.

- Combining with Other Indicators: To improve the accuracy of the Zig Zag Indicator, consider combining it with other technical indicators. Moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) are popular choices. These additional indicators can confirm signals generated by the Zig Zag Indicator and help you avoid false signals.

Advanced Trading Techniques

1. Identifying Trend Reversals

One of the primary functions of the Zig Zag Indicator is to pinpoint trend reversals. By focusing on substantial price shifts, the indicator aids traders in identifying potential market turning points. To enhance this technique:

- Confirmation with Volume: Use volume data to confirm trend reversals. A significant price move accompanied by high trading volume is more likely to indicate a genuine trend reversal.

- Divergence with Oscillators: Watch for divergence between the Zig Zag Indicator and oscillators like RSI or MACD. If the price forms higher highs while the oscillator forms lower highs, it may suggest a potential reversal.

2. Trend Following

The Zig Zag Indicator can also be leveraged for strategies that follow the trend. By recognizing the main trend direction, traders can make more informed decisions about when to enter and exit trades.

- Entry Points: Use the Zig Zag Indicator to spot the onset of a new trend. Enter the trade when the indicator confirms a trend reversal and other indicators (e.g., moving averages) align with the new trend direction.

- Exit Points: Determine exit points by monitoring the Zig Zag Indicator for signs of trend exhaustion or reversal. When the indicator suggests a potential trend reversal, consider closing your position to lock in profits.

3. Spotting Corrections

In addition to identifying trends and reversals, the Zig Zag Indicator is useful for identifying market corrections. These are temporary price declines within an overall uptrend or rallies within a downtrend.

- Fibonacci Retracement Levels: Combine the Zig Zag Indicator with Fibonacci retracement levels to identify potential support and resistance levels during corrections. This can help you determine optimal entry points for buying the dip or selling the rally.

- Support and Resistance: Use the Zig Zag Indicator to identify key support and resistance levels based on previous significant price moves. These levels can act as potential entry or exit points during corrections.

4. Trading Patterns

The Zig Zag Indicator can help traders identify classic chart patterns such as head and shoulders, double tops and bottoms, and triangles. These formations can provide important trading signals.

- Pattern Confirmation: Use the Zig Zag Indicator to confirm the formation of chart patterns. For example, in a head and shoulders pattern, the indicator can help identify the shoulders and head more clearly.

- Pattern Targets: After confirming a pattern, use the Zig Zag Indicator to set price targets. Measure the height of the pattern and extend it from the breakout point to estimate the potential price movement.

5. Risk Management

Effective risk management is crucial in trading. The Zig Zag Indicator can aid in setting stop-loss levels and managing risk.

- Stop-Loss Placement: Place stop-loss orders just below the recent swing low (for long positions) or above the recent swing high (for short positions) identified by the Zig Zag Indicator. This helps protect your position from significant adverse price movements.

- Trailing Stops: Use the Zig Zag Indicator to set trailing stops that adjust as the price moves in your favor. This strategy enables you to secure profits while allowing the trade to continue its course.

Conclusion

The Zig Zag Indicator is a powerful tool that, when used correctly, can significantly enhance your trading strategy. By focusing on substantial price movements and filtering out noise, it helps traders identify trends, reversals, corrections, and patterns with greater precision. To maximize its effectiveness, combine the Zig Zag Indicator with other technical indicators, adjust its parameters to suit your trading style, and incorporate it into a comprehensive risk management plan. By mastering advanced trading techniques using the Zig Zag Indicator, you can gain a deeper understanding of market dynamics and make more informed trading decisions. Whether you are a day trader, swing trader, or long-term investor, this versatile tool can be a valuable addition to your trading arsenal.