In the dynamic realm of Forex trading, it’s effortless to find yourself ensnared in what’s known as the trader’s pitfall – a vortex of setbacks, disillusionment, and overlooked chances. But don’t fret! By grasping the typical stumbling blocks and applying successful tactics, you can liberate yourself from this cycle and maneuver through the Forex market with assurance. Let’s delve into strategies to evade the trader’s pitfall and prosper in Forex trading.

Introduction: Breaking Free from the Trader’s Trap

In this article, we’ll delve into the common pitfalls that trap traders in a cycle of doom in the Forex market. From overtrading to emotional decision-making, we’ll uncover the factors contributing to this vicious cycle and provide actionable tips to help traders escape its grasp.

The Allure of Overtrading

One of the most common traps for traders is the temptation to overtrade – executing too many trades in a short period in the hopes of maximizing profits. However, overtrading often leads to impulsive decisions and increased transaction costs, ultimately eroding profits rather than enhancing them.

Emotional Rollercoaster: Fear and Greed

Fear and greed are powerful emotions that can cloud judgment and lead traders astray. Fear of missing out (FOMO) drives impulsive buying decisions, while greed can tempt traders to hold onto losing positions in the hope of a reversal. Managing emotions is key to avoiding the trader’s trap.

Lack of Risk Management

Effective risk management is essential for long-term success in Forex trading. Traders who neglect risk management strategies such as setting stop-loss orders or proper position sizing are more vulnerable to significant losses that can derail their trading journey.

Chasing the Holy Grail: Indecision

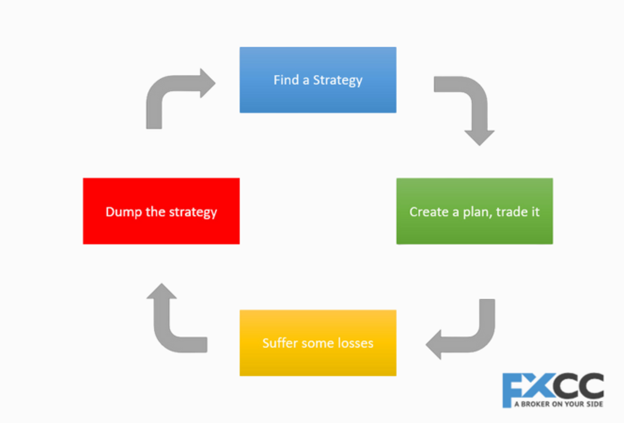

Many traders fall into the trap of constantly searching for the perfect trading strategy or indicator – the “holy grail” of Forex trading. This quest for perfection often leads to indecision and missed opportunities, preventing traders from taking decisive action when it matters most.

Ignoring Market Analysis

Ignoring fundamental and technical analysis is a recipe for disaster in Forex trading. Successful traders understand the importance of analyzing market trends, economic indicators, and price patterns to make informed trading decisions and stay ahead of the curve.

Impatience and Instant Gratification

In today’s fast-paced world, traders often succumb to impatience and seek instant gratification. However, Forex trading requires patience, discipline, and a long-term perspective. Rushing into trades without proper analysis can lead to costly mistakes.

Falling Victim to FOMO

Fear of missing out (FOMO) can be a powerful force in Forex trading, causing traders to abandon their trading plans and chase after the latest market trends. However, FOMO-driven decisions are often driven by emotion rather than logic, leading to poor outcomes.

Over Reliance on Trading Signals

While trading signals can be a valuable tool for identifying potential trading opportunities, relying too heavily on them can be a mistake. Traders should use signals as part of a comprehensive trading strategy, rather than blindly following them without question.

Tips to Break Free from the Trader’s Trap

- Develop a Solid Trading Plan: Outline clear entry and exit criteria, risk management strategies, and trading goals.

- Stick to Your Strategy: Avoid deviating from your trading plan based on emotion or impulse.

- Practice Patience: Wait for high-probability trading setups rather than forcing trades.

- Focus on Quality Over Quantity: Prioritize the quality of your trades over the quantity.

- Continuous Learning: Stay informed about market developments and continuously refine your trading skills.

Conclusion:

By understanding the common pitfalls that trap traders in the cycle of doom and implementing effective strategies to mitigate risk, traders can break free from the trader’s trap and achieve success in Forex trading. Remember, patience, discipline, and a well-defined trading plan are the keys to mastering the Forex market.