Have you ever come across the term “forex margin trading”?

Before getting acquainted with the principles of forex margin trading, we want to start in order and analyze all the components of this term.

So, let’s start with the margin.

What is the margin?

This is the difference that exists between the selling price and the buying price. To make it clear, let’s take an example. Suppose the selling price of one product is $100, and the direct cost is $60. In this example, the forex margin is $40.

What is lending?

As for lending, you have an idea about this word. A loan is a kind of “borrowing” a certain amount of money. A loan is beneficial for those who provide it (brokers).

We are gradually approaching to our topic. So, based on the above, you can try to define this term yourself. Will you try?

Ok, let’s mention it anyway.

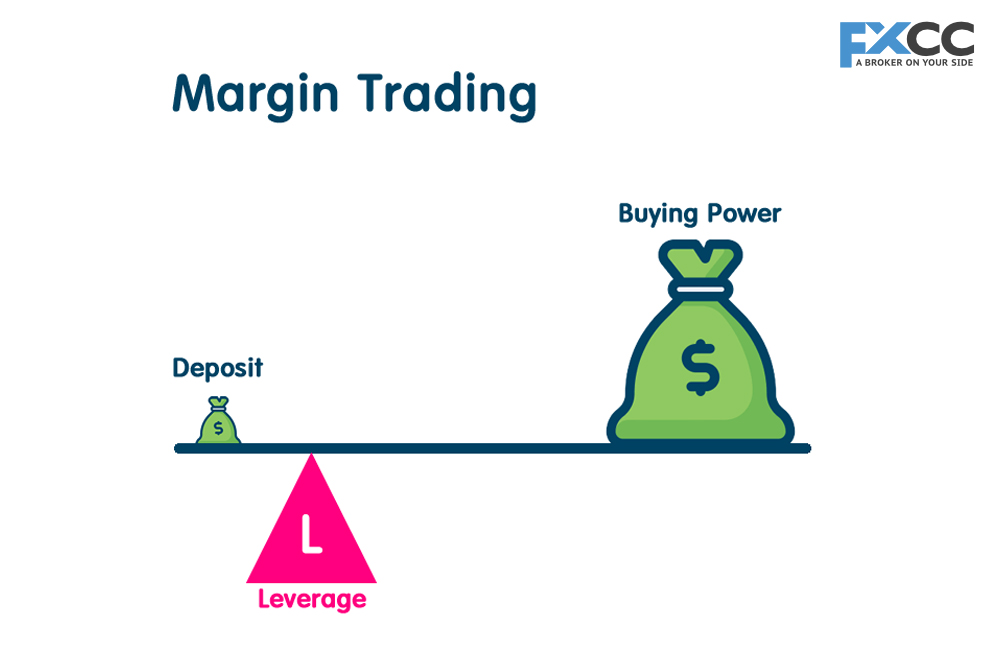

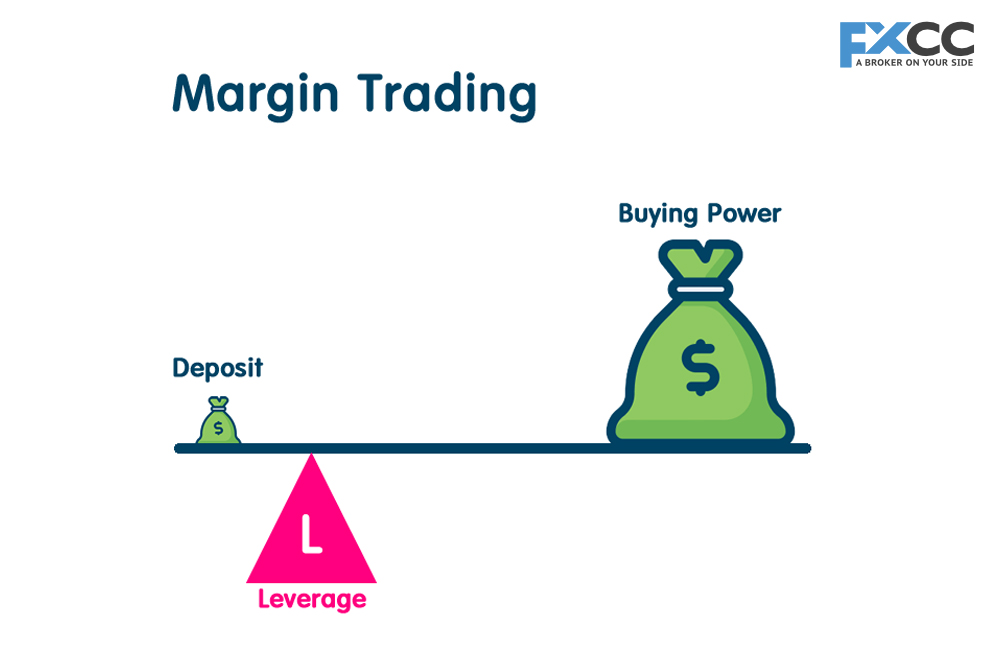

Forex Margin Trading is a transaction using a loan. In the forex market, credit is called marginal leverage. Margin leverage is a loan without interest. The deposit is the client’s money.

With the help of such leverage, traders increase their amount from ten to a thousand times. And this is the main plus of margin trading: to get a good profit from insignificant deposits.

How does margin trading work?

So, the first thing the trader does is put money into the broker’s account. Its size is valid from one to a thousand. Such an indicator is written as 1: 1000.

The second number is an indicator of the selected leverage. As soon as you perform a particular operation in the forex, the deposit will always increase with the amount of leverage.

Example: Your deposit is $100, and your leverage is $10,000. Based on this, one hundred thousand dollars are available to you.

It is important to understand that the trader has the right to dispose of only his deposit, but the loan you received serves to make large transactions in trading.

The principle of margin lending

You must understand that the result will be pleasant when you use so-called financial leverage. This principle is very popular all over the world since it creates all the conditions for traders to make money even on weak market fluctuations and with a small deposit.

In the case of strong fluctuations, traders increase their income several times. Traders receive income from the price difference.

Bottom Line

The first thing to always remember is that when you increase margin funds, you also increase your risks. For this reason, leverage that is more than 1: 100 is recommended for intraday trading and on short time frames.

If you have significant leverage, then positions should be opened in small lots. As soon as there are signs of a trend reversal, then close all unprofitable positions. It is advisable to trade with leverage of 1:30. So you will open fewer transactions or several transactions with a smaller volume and will always control your risk.

New to Forex trading? Don’t miss these beginner guides from FXCC.

– Learn Forex Trading step by step

– How to read Forex charts

– What is spread in Forex Trading?

– What is a Pip in Forex?

– Low Spread Forex Broker

– What is Forex Leverage

– Forex Deposit Methods