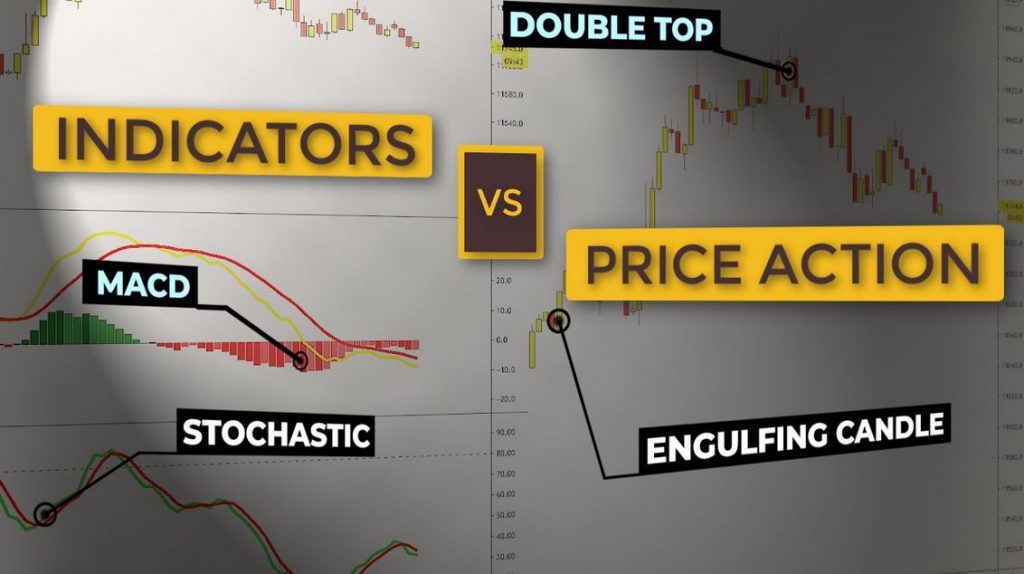

Almost as old as trading itself is the debate about whether price action trading is better than indicator trading. This article will give traders a fresh perspective on this age-old debate by debunking the five most common opinions about Price Action vs. Trading Indicators.

Price action is better than indicators

Many traders claim that price action is a better trading strategy. However, if you dig deeper, you discover that price action and indicators are not different. Charts with candles or bars provide a visual representation of price information.

By applying a formula to price information, indicators can offer the same information. It doesn’t matter how indicators add or subtract from the price information you see in your candlesticks – they manipulate the data differently. We will see this in more detail in the following parts.

Indicators are lagging – price action is leading

Traders argue that unreliable indicators don’t understand their true purpose and meaning. Indicators take price action from the past (the indicator’s settings determine the amount), apply a formula, and visualise the results. You can thus interpret what your indicator shows you due to past price movements.

Traders who examine pure price patterns do the equivalent thing; if you look at a Head and Shoulder pattern or Cup and Handle pattern, for instance, you are also looking at past price action, which has already moved away from the potential entry point.

Each uses price information from the past, so if you wish to call it that, ‘lagging.’ To overcome the lagging component, you need to use a shorter setting on your indicator or only look at a handful of past candlesticks. Nonetheless, the significance of the analysis decreases when you include fewer details.

Price action is simple and better for beginners

Could it be? Trading often boils down to determining the best way to use a tool, rather than one thing being more important than another. The hammer is like a screwdriver if you know when and how to use it. If you know when and how to use them, they are both beneficial tools, but neither will be helpful if you don’t.

A novice price action trader can easily feel lost without experience or proper guidance. It isn’t as easy as it sounds to trade candlesticks because many factors are often overlooked, including the size of candlesticks, their comparison to past price movements, and the volatility of wicks and bodies. Do not choose price action based on its simplicity. An individual who does not understand the nuances of price action trading will be prone to misinterpreting charts.

Price action is the real way of trading

In conclusion, “professionals” do not use indicators. Again, we have a very hard time validating such a claim, so it’s all personal preference. By using indicators, traders can process data faster. Without much subjectivity, because indicators only examine specific aspects of a chart – momentum indicators consider only momentum – to help them process data.

Bottom line

It is important to remain open-minded about this issue and not get swept up in emotion. An investor must choose his trading tools wisely and be aware of both the benefits and risks associated with each type of approach. Comparing price action vs indicator trading does not show a clear winner or loser. A trader must utilize the trading tools at his disposal to make trading decisions.