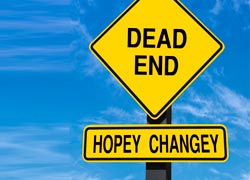

There’s not much we can thank Sarah Palin for, given that she lowered the pantomime that is USA politics to new depths. But her one liner directed at Barack Obama must have cut him to the quick. “How’s that hopey changey thing working out for ya?” was a world class put down that at a stroke cut through his sophist neuro linguistic programming and posturing. In 2008 many were fooled, including those of us on the other side of the Atlantic who recognized the use of NLP but still hoped he’d firstly find a new direction in the middle east turmoil the USA had created and secondly arrest the global meltdown the USA investment banks had caused.

In June Obama addressed a gathering of mainly 3,000 students at Cairo university. Delivering a breath-taking speech of promise it raised the spirits and hopes for the tinder box regions of the middle east, it came to nothing, there was no follow through. His promise to help Palestine to become a member of the UN likewise, but perhaps his saddest moment came after the Israeli prime minister Benjamin Netanyahu “tore him a new one” (as they say in the USA), in an annex at the oval office in front of the press and tv cameras…

Netanyahu turned on him for daring to suggest, in an earlier address, that Israel had to push it’s Borders back to the internationally agreed convention lines of the pre 1967 conflict. Obama slumped in his chair, put his chin on his hand, said nothing and sat there scolded. Not having access to his Tele-Prompter made his speechless position embarrassing. If it was politeness to a guest on his part we’ll never know, what is for sure is that it came across as intense weakness.

The profound disappointment many feel in the USA with regards to his tenure is illustrated in the latest poll ratings where Obama’s approval rating has dropped below Jimmy Carter’s. The possibility that he may ultimately prove to be a one term president, considering so many bought into the “hope and change, yes we can” rhetoric, is truly gut wrenching. For the first time in decades a human being, in such a position of power, appeared to be going ‘beyond’ politics.

Obama’s slow ride down Gallup’s daily presidential job approval index passing below Jimmy Carter, has earned Obama the worst job approval rating of any president at this stage of his term in modern political history. Since March, Obama’s rating has hovered above Carter’s, considered the 20th century’s worst president, but today Obama’s punctured Carter’s dismal job approval line. On their comparison chart, Gallup put Obama’s job approval rating at 43 percent compared to Carter’s 51 percent.

Back in 1979, Carter was far below Obama until the Iran hostage crisis, eerily being duplicated in Tehran today with Iranian protesters storming the British embassy. The early days of the crisis helped Carter’s ratings, though his failure to win the release of captured Americans, coupled with a bad economy, led to his defeat by Ronald Reagan in 1980.

According to Gallup, here are the job approval numbers for other presidents at this stage of their terms, a year before the re-election campaign:

[unordered_list style=”tick”]

- Harry S. Truman: 54 percent

- Dwight Eisenhower: 78 percent

- Lyndon B. Johnson: 44 percent

- Richard M. Nixon: 50 percent

- Ronald Reagan: 54 percent

- George H. W. Bush: 52 percent

- Bill Clinton: 51 percent

- George W. Bush: 55 percent

[/unordered_list]

Gallup finds that Obama’s overall job approval rating so far has averaged 49 percent. Only three former presidents have had a worse average rating at this stage: Carter, Ford, and Harry S. Truman. Only Truman won re-election in an anti-Congress campaign that Obama’s team is using as a model.

Overview

Bank of America Corp., Goldman Sachs Group Inc. and Citigroup Inc. have had their long-term credit grades reduced to A- from A by Standard & Poor’s after the ratings firm revised criteria for dozens of the largest global lenders. Standard & Poor’s made the same cut to Morgan Stanley and Bank of America’s Merrill Lynch unit. JPMorgan Chase & Co. was reduced one level to A from A+. S&P upgraded Bank of China Ltd. and China Construction Bank Corp. to A from A- and maintained the A rating on Industrial and Commercial Bank of China Ltd., giving all three lenders higher grades than most big U.S. banks.

Consumer sentiment in the USA rebounded in November from a 2-1/2-year low last month and U.S. retailers reported strong sales as the holiday shopping season got off to a positive start last week. The Conference Board said on Tuesday its index of consumer attitudes jumped to 56.0 from 40.9 in October, hitting the highest level since July and handily topping economists’ forecasts for 44.0. Still, the confidence index remains historically low and is well below a recent peak of 72.0 in February.

Europe’s debt crisis is entering its “endgame,” according to Nomura Holdings Inc.’s Jens Nordvig, who expects a tighter fiscal union and steps by the ECB to reduce borrowing costs.

[quote]We’re now heading into a very final phase of this crisis where we are at a crossroad, where we either have to have a proper backstop or we’re going to face a breakup. The most likely scenario is one where the ECB provides a backstop in the next couple of months.[/quote]

Euro zone ministers struggled to ramp up the firepower of their rescue fund and raised the possibility of asking the IMF for more help on Tuesday after Italy’s borrowing costs hit a euro lifetime high of nearly 8 percent. Two years into Europe’s sovereign debt crisis, investors are fleeing the euro zone bond market, European banks are dumping government debt, deposits are draining from south European banks and a looming recession is aggravating the pain, fuelling doubts about the survival of the single currency.

Italy had to offer a record 7.89 percent yield to sell 3-year bonds, a stunning leap from the 4.93 percent it paid in late October, and 7.56 percent for 10-year bonds, compared with 6.06 percent at that time.

The yields were above levels at which Greece, Ireland and Portugal were forced to apply for international bailouts, but European stocks and bonds rallied in apparent relief at the strong demand, with the maximum 7.5 billion euros sold.

In Brussels, Eurogroup ministers agreed to release an 8 billion euro aid payment to Greece, the 6th instalment of 110 billion euros of loans agreed last year and necessary to help Athens stave off the immediate threat of default. The go-ahead for the sixth disbursement of funds under the fully taxpayer-funded package of 110 billion euros shifts the spotlight to a second rescue of Greece that foresees 50 percent losses for private investors in Greek bonds. The new aid plan, crafted at an October summit, also includes 130 billion euros in extra public funds.

Ministers said the International Monetary Fund may have to provide more help, possibly bolstered with more European money.

“We will have to look at the IMF which can also make available additional funds for the emergency fund. I think countries in Europe and outside of Europe should be prepared to give more money to the IMF,” – Dutch Finance Minister Jan Kees de Jager.

The ministers will agree details of how to leverage the 440 billion euro European Financial Stability Fund (EFSF) so it can help Italy or Spain should they need aid, although worsening market conditions mean it is likely to miss the original target of 1 trillion euros.

With about $390 billion currently available for lending, the Washington-based IMF may not have enough money to meet demand if the global outlook worsens, Managing Director Christine Lagarde has said. A group of 20 leaders earlier this month discussed a possible increase in IMF resources as a way to channel loans from the rest of the world. They failed to agree on a number and demanded more details of Europe’s plans to stem the debt crisis before committing fresh cash.

Lagarde has since continued meeting with officials about potential contributions. She has recently traveled to China, Russia and Japan and this week she is in Mexico and Brazil, which have said they are willing to do their part provided Europe boosted its own rescue efforts. Speaking from Lima yesterday, Lagarde, a former French finance minister, said Europe needs “a comprehensive, rapid set of proposals that would form part of a comprehensive solution, and the IMF can be a party to that.”

Market Overview

Stocks and commodities rose for a second day as U.S. consumer confidence increased by the most since 2003 and European finance ministers discussed efforts to tame the region’s debt crisis. Treasuries pared losses.

The Standard & Poor’s 500 Index added 0.2 percent to 1,195.44 at 4 p.m. in New York, trimming its rally from 0.9 percent, according to preliminary closing data. The Stoxx Europe 600 Index rose 0.8 percent. The euro climbed 0.1 percent $1.3329 after earlier erasing a gain of as much as 0.9 percent. The S&P GSCI gauge of 24 commodities advanced 1.3 percent as oil approached $100 a barrel. Ten-year U.S. Treasury yields rose two basis points to 2 percent after dropping 1 point.

Economic calendar data releases that may affect market sentiment in the morning session

Wednesday 30 November

00:30 Australia – Private Capital Expenditure 3Q

01:30 Japan – Labour Cash Earnings Oct

05:00 Japan – Construction Orders (YoY) October

05:00 Japan – Housing Starts October

10:00 Eurozone – CPI Estimate November

10:00 Eurozone – Unemployment Rate October

The CPI and unemployment rate in Europe are the key data releases in the morning session. A Bloomberg survey predicts CPI at 3.0%, unchanged from last month’s figure. Economists polled by Bloomberg gave a median forecast of 10.2% for unemployment, which would be unchanged from last month’s figure.