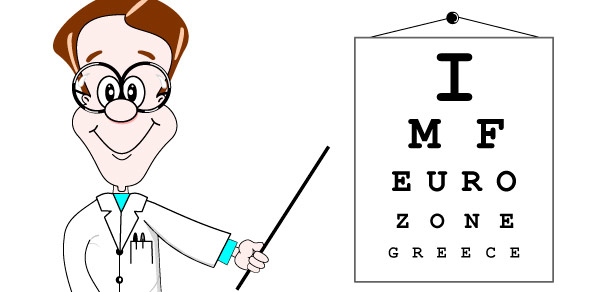

There is one headline and discussion point, in relation to the Greece debacle, which constantly catches the attention IF you’re concentrating;

“At stake is a target of lowering the debt to a more manageable 120 percent of gross domestic product by 2020. EU and IMF officials believe that target, which assumes Greece will run a budget surplus next year, excluding the massive cost of its debts, will be missed. Under the main scenario of an analysis by the European Commission, the European Central Bank and the International Monetary Fund, estimates suggest that Greek debt will fall to only 129 percent of GDP in 2020.”

Therefore by employing the most optimistic metrics the primary Greek debt versus GDP ratio could fall to 120% by 2020 and this does not take into consideration other debts such as the burden of personal debt which could severely impact on bank reserves and liquidity/solvency requiring further rescues etc. The standard economic metric by which many countries are judged to still be healthy is a debt v GDP ratio not exceeding 65-80%, yet here we are, with the troika openly admitting that a figure approaching double the lower threshold is the best that can be achieved, but that’s apparently the basis upon which a rescue deal could be struck.

It’s incredulous to imagine that Greece can stick to the overall plan, even if it’s lined up each week like a dutiful schoolboy, asked if its household chores are taken care of and then doled out pocket money in order to pay the remaining skeleton civil servants their reduced wage and fill up the ATMs. There are bound to be bumps in the road between now and 2020 and as Greece inevitably catches colds it’ll be forced to take more punitive medicine. However, are Greeks signing up to a minimum of eight years of incredible and arguably unnecessary hardship, when the obvious answer from the outset was a planned orderly default?

As we watch Iceland emerge from its catastrophe of 2009 some journalists and economic commentators will point fingers and suggest that there were, still are, alternatives. But having made Greece the pinnacle and pivotal issue (as the rescue mission to save the euro and Eurozone) the wider powers that be in Europe may have created a rod too big for every Euro citizens’ back.

2020 looks a long way off and any thought that Greece will be transformed into anything other than a zombie state by such time is wishful thinking. It’ll continue to drag and paw at it’s cruel master, until at some stage the schoolboy may tire of dutifully queuing up and asking for the sustenance level handout..

Market Overview

Global equities rose for a fourth day whilst metals rallied as a consequence of China’s central bank cutting the reserve requirements for banks, while the euro strengthened before European leaders meet to discuss a Greek rescue. Oil reached a nine-month high due to Iran stating it’s ceased crude exports to Europe.

The MSCI All-Country World Index gained 0.4 percent as of 8:00 a.m. in London. The Stoxx Europe 600 Index climbed 0.6 percent and Standard & Poor’s 500 Index futures advanced 0.3 percent. The euro rose 0.5 percent to $1.3199. The yen weakened against 13 of its 16 major peers after Japan posted the biggest monthly trade deficit on record. Ten-year German bund yields added two basis points to 1.95 percent. Copper reversed its six days of losses, increasing by 1.4 percent, whilst oil rose 1.5 percent.

Market snapshot at 9:30 am GMT (UK time)

Despite publishing record trade deficit figures the main Japanese index, the Nikkei, closed up over 100 points or 1.02%. The Hang Seng closed down 0.31% and the CSI closed up 0.14%. The ASX 200 closed up 1.44%, the healthiest rise in the Asian Pacific region, responding positively to the news that China’s lowering of reserve requirements for banks may increase demand for the raw materials Australia exports and give an overall boost to their economy. European bourse indices have enjoyed a bounce in the first part of the morning session, the STOXX 50 is up 0.84%, the FTSE is up 0.54%, the CAC is up 0.73% and the DAX up 0.75%. The main Athens exchange is up 1.42% the leading ‘riser’ this morning. The SPX equity index future is currently up 0.36%, ICE Brent crude is up 0.97% over €120 a barrel, Comex gold is up $9.70 an ounce.

Commodity Basics

Brent oil for April settlement increased 0.97 percent to $120.53 a barrel on the London-based ICE Futures Europe exchange. Copper in London rose as much as 2.7 percent to $8,396.50 a metric ton. Zinc increased 1.9 percent to $1,982 a ton, nickel added 1.4 percent to $19,900 and tin climbed 1.6 percent to $23,850.

Forex Spot-Lite

The yen fell 0.2 percent to 104.79 per euro and earlier touched 105.75, the weakest since Nov. 14. Japan’s exports dropped 9.3 percent from a year earlier, the Ministry of Finance said today, compared with the median estimate among economists for a 9.4 percent decline. The euro gained for a third day against the dollar. The euro rose 0.5 percent to $1.3199.

German Chancellor Angela Merkel, Greek Prime Minister Lucas Papademos and Italian Premier Mario Monti expressed confidence on Feb. 17 that ministers will resolve open questions. Should they fail to back the bailout plan at the Brussels meeting, the issue could be pushed back to the next European Union summit on March 1.

Australia’s currency rose 0.5 percent to $1.0762 and New Zealand’s so-called kiwi gained 0.9 percent to 83.97 U.S. cents. The two nations, which count China among their largest export destinations, gained on prospects the reserve-ratio cut will also boost demand for commodities.