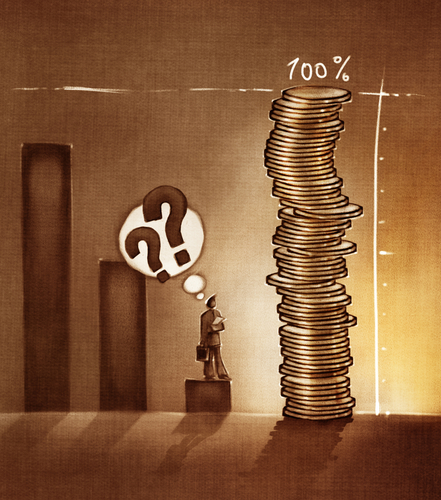

A gross profit margin calculator is an online tool used by investors to determine the financial health of an enterprise. It basically calculates the percentage of revenue left after deducting the cost of goods sold. In skin and bones terms, gross profit margin is a profitability ratio. It is one of the many metrics usually used by stock investors to determine the viability of investing in a company that is currently under its consideration and study.

The gross profit margin is calculated based on the formula below:

Gross Profit Margin = [1 – Cost of Goods Sold/Revenue] x 100

The gross profit margin is normally calculated on an annual or quarterly basis with the results compared against each other or plotted on a chart where it will give a historical perspective of the company’s profitability.

Is a gross profit margin calculator of any use to foreign currency trading? My answer is both yes and no. There is one segment of the foreign currency market that may find use for this calculator. This is the foreign currency exchange traded funds or Forex ETFs. This is an investment fund solely to trade foreign currency market much like a pooled account and operates like a mutual fund. You can participate in such funds by buying shares. And since they are traded in an exchange, you can buy shares just like in a stock exchange.

Similarly, before investing on any forex ETF, you need to analyze the past performance of the fund along with other due diligence work. And of course, part of the due diligence would be determining the fund’s profitability ratio on a per share basis. You can use the formula above to determine the gross profit margin of an ETF share by substituting the revenue with the current value of each share and the cost of goods with the acquisition cost of each share plus all the accruing fees relative to the purchase and sale of the share. The resulting gross profit margin will give you a snapshot of the profitability ratio of the fund’s performance.

However, in foreign currency trading, it is widely accepted that a sterling past performance can never guarantee profitable future trades. The forex market is extremely volatile and too unpredictable to guarantee that the future performance will be as profitable as the past. A commendable gross profit margin is but a meaningless medal that is pinned to the fund manager’s shirt but will never mean guaranteed profits for you.

For retail forex trading, a gross profit margin calculator is of no value at all. In the first place, there is no cost of goods to consider. Besides, retail forex trading is done using a margin trading system with no brokers’ fees to worry about. On top of that, revenues are just as volatile as the price swings in the market – what may appear as profits now can easily turn into losses the next minute.

In short, none of the parameters used in calculating the gross profit margin can be adapted for retail forex trading. And if ever anyone finds a way to use the gross profit margin calculator for retail forex trading, it will be of insignificant value as the resulting calculations or profit ratio do not in any way help the individual traders make money trading the currency pairs.

Comments are closed.