Leverage in foreign exchange trading is a puzzle. How do you determine how much leverage to use while trading forex currency?

You can get a loan from your service provider if you use leverage. It allows the trader to work with a smaller but larger sum of money.

More significant debt carries greater peril. You can achieve this without using excessive leverage and through careful account management. “Pips” are the standard measure of currency movement in the trading industry.

On the forex exchange market, leverage can reach as high as 100 to 1. Effectively using leverage and margin is a crucial skill for any trader to master.

The difference in cost between the two is negligible. Since these adjustments are typically made in bulk, even modest price adjustments might generate large profits.

Look at what happens in this example!

If you have $1,000 in your trading account, you can invest up to $100,000. So what gives here? Fear is widely believed to play a role in leverage.

The account’s risk is manageable if it’s easy to use. Compared to other markets, entering and exiting the trade is very simple.

How to calculate the amount of margin used?

Multiply the deal size by the margin % to get the amount of margin used. Deduct the total margin you utilised for your deals to calculate how much equity you left in your trading account. This will give you a rough estimate of the room for error in your budget.

Any trade’s margin can be calculated using the formula:

Margin Requirement = Current Price × Units Traded × Margin

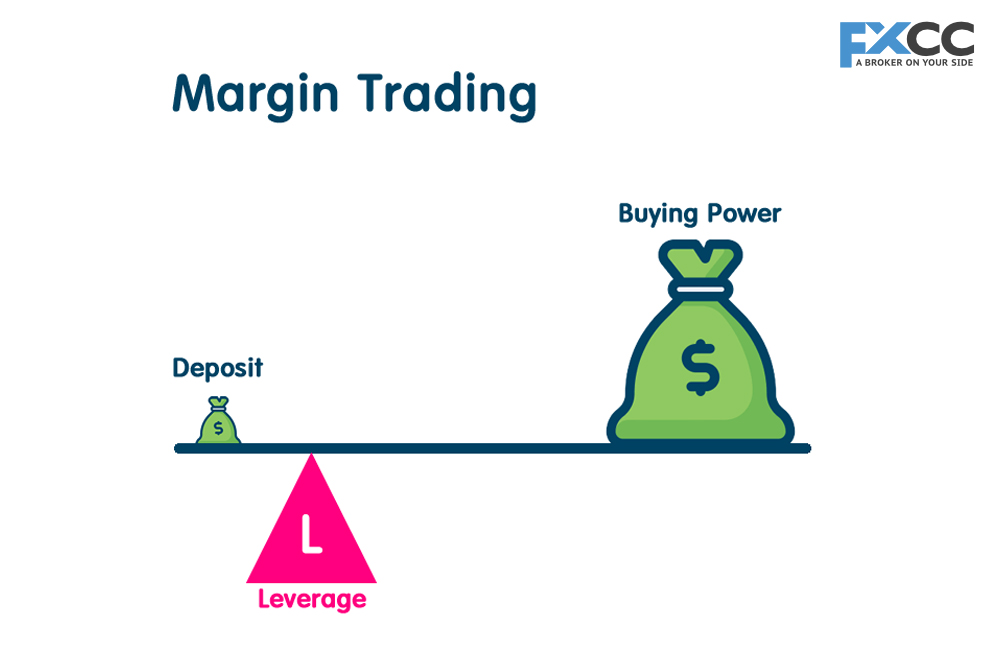

What is the distinction between leverage and margin trading?

In addition to differences in context and function, there are additional distinctions between leverage and margin trading.

Leverage is a measure of a company’s ability to make purchases, and it is typically achieved through the use of debt.

Borrowing is fundamental to the concepts of leverage and margin. However, when trading on margin, you must utilise the safety net provided by the funds in your trading account. You can borrow funds from any lender at your own risk.

Major rules to apply when selecting leverage for trading

- Use the minimum amount of margin necessary.

- Protect your capital with tail stops and cap your losses.

- Finally, only risk 1% -2 % of your capital on any position.

As the maximum leverage is increased, the required margin decreases. The relationship between the pound and the yen is a practical example. Large swings in the rate are possible because of fluctuations in the exchange rate.

A currency with a high degree of volatility will fluctuate widely. Stop-loss orders are used as a precautionary measure by forex businesses.

Real leverage often differs from margin leverage because most traders don’t utilise their entire account balance as a margin for each deal.

Bottom line

This comprehensive tutorial has helped you understand margin requirements and leverage effectively. Be cautious in your application of the framework you are using. Learn from the pro traders’ strategies for calculating margin and leverage to maximise profits.