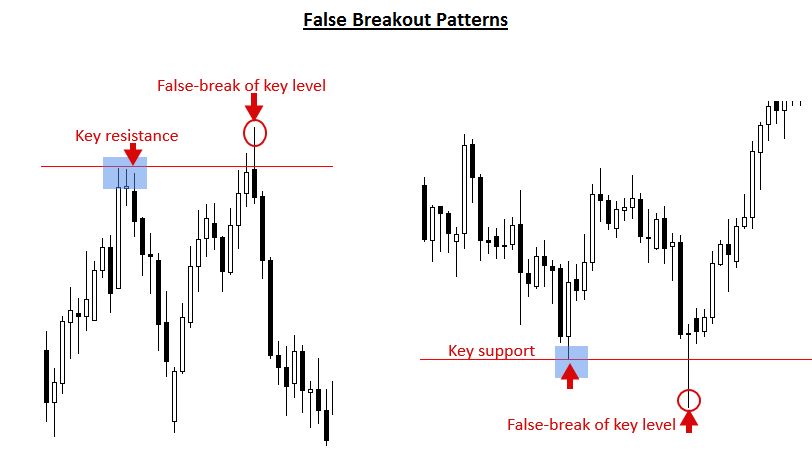

Are you aware of what a false breakout is and how you can escape it? In general, the false breakout occurs when the price moves temporarily below or above the key support or resistance level. But after a little while, it returns to the beginning. Possibly, this is the worst-case scenario for a breakout trader who just entered the trade when it broke out.

You can either ride out false breakout setups or close your trades if you want to stay away from them. You may avoid losing money quickly if you do this. But surely, this solution isn’t as appealing as you thought it would be! To avoid future losses, you need to follow some basic rules and strategies.

What causes false breakouts?

False breakouts can have numerous causes, but one general one is price movement temporarily. A support or resistance level is found when the price moves below or above it. Therefore, traders must identify that moment when the price starts to move temporarily without alarm.

Act on trade in a real-time

In your research, you will probably come across different approaches to counter false breakout strategies. The best solution is to act on trades in real-time. When the price is about to break a certain key level, this will occur. To confirm the strength of a breakout, the trader must wait until the candle closes.

Settlement of alerts based on candle’s close prices

Don’t wait around for the breakout to come to an end on its own! It’s a big mistake. Instead, using price alerts is highly recommended for you. As a general rule, candle closing prices serve as the trigger for price alerts. In addition, a trader will just receive an alert when the resistance or support is fully broken and stays broken until the close of that particular candle. Upon receiving the alert, you need to log into your PC and begin placing the trade.

It’s all about probabilities

The technical trader knows that at the end of the day, it all comes down to probabilities. So the more factors you include in your support over any setup, the greater odds you’ll receive that will result in profit.

When it comes to the Forex breakout strategy, the main factor is simply to wait for a close above or below the key level. In this way, you will set the validity and therefore mitigate the risk of a false breakout.

Bottom line

A false breakout is also known as a failed breakout. And we have already described to you that this whole breakout strategy is about the price movement through resistance and support. Our best solution of waiting for candles is presented right above for you, which you should follow to better mitigate the risk of breakout setup. According to us, the best time frames for confirming the breakout are the 4 hours and the daily time frames. Learn more about why false breakout happens and how you can better handle this forex situation as a beginner.