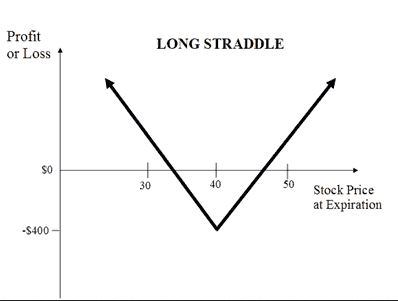

A straddle strategy entails holding long and short positions in the same securities simultaneously. Take this as an example: A trader buys and sells call and puts options on the same underlying asset at a specific point in time. The expiration date and price of both options are identical.

Stop Out Recovery Straddle Trade Strategies

Straddle strategy templates are pre-configured on the trading panels and maybe ‘expanded’ on top of your primary trade setting.

The panel will open a second order with the straddle technique applied when you place a trade on it. It is supposed to act like recovery money management, where if your trade fails, your straddle goes live and initiates a new trade in the opposite direction.

The goal is to transform a lost transaction into a winning one without exposing yourself to needless risks. First, let’s look at the panel’s straddle recovery options.

Straddle Mirror Trade

The mirror trade is the most straightforward. In this, a second trade in the opposite direction will be placed by the panel once your original trade is put up, with the entry and stop-loss prices reversed. Your primary trade’s stop-out price will serve as the straddle trade’s entry price. So, if your initial trade gets stopped out, you’ll be able to open a straddle transaction at the same time as your original trade. Observe the following example.

Here, we’ve chosen to target a rejection candle, a reversal candlestick pattern. I’ve requested the panel to use the 50 percent retracement approach and put the stop below the candle’s low. A straddle mirror trade is one in which you reverse the stop loss and entry price of your initial trade to make the opposite bet in the other direction.

This is an example of what happens when a trade fails and the candlestick pattern fails to function and leads you to lose money. You feel like throwing your computer out the window, but that’s just a joke.

Depending on the nature of your goal, you may be able to recoup some of your losses with a straddle if the purchase trade fails. As soon as a deal goes awry, the market tends to go the opposite way. They are meant to take advantage of the market’s movements following losing deals.

Straddle Trade Around a Candlestick

The recovery straddle order will be built around the target candle you choose in your entrance strategy using the straddle technique. Your initial trade’s stop-loss is used as the entry price for a straddle transaction; you will be entered into the straddle trade when your previous trade is knocked out. A straddle stop-loss that mirrors the initial transaction may be excessively aggressive. The stop applied in the mirror trade version is a touch tight, as the example with the retracement entry.

In this method, the stop loss is placed at the target candle’s high or low. Observe the following example.

The only difference between this trade and the previous one is that we employed the ‘use entry candle’ approach instead of the straddle method. The only item that has altered is the stop-loss location, which is now at the high of the entry target candle. Assuming we are launching a sell trade, we would place a stop order below our target candle’s lower low. A more cautious straddle trade provides a better stop loss in this instance. Straddle trading is a similar strategy to the original one, but it’s designed to make up for losses if the original strategy fails.

Bottom line

Recovery management through straddle trading is a fascinating idea. When it comes to straddling trades, you should be aware of the panel’s handling of these types of transactions, so study the guide thoroughly. As usual, we wish you the best of success on the charts!