Margin in forex, and its different sub-divisions, can be a bit confusing, even for those with a strong mathematical background.

It’s not that you should worry a lot about margin calculations if you aren’t going to use them in your day-to-day forex trading.

We’ll learn how to use margins to improve your forex trading results and determine what’s essential to know about margins.

Margin is a concept you can incorporate into your daily forex trading if you have already opened a forex trading account. But this article isn’t about repeating theory but looking at practical concepts.

Margin isn’t just a one-time decision.

Upon opening your account, you choose the amount of leverage you want. Most FX traders don’t change their margin after that. This can lead them to forget about it. But it directly affects how much they can trade.

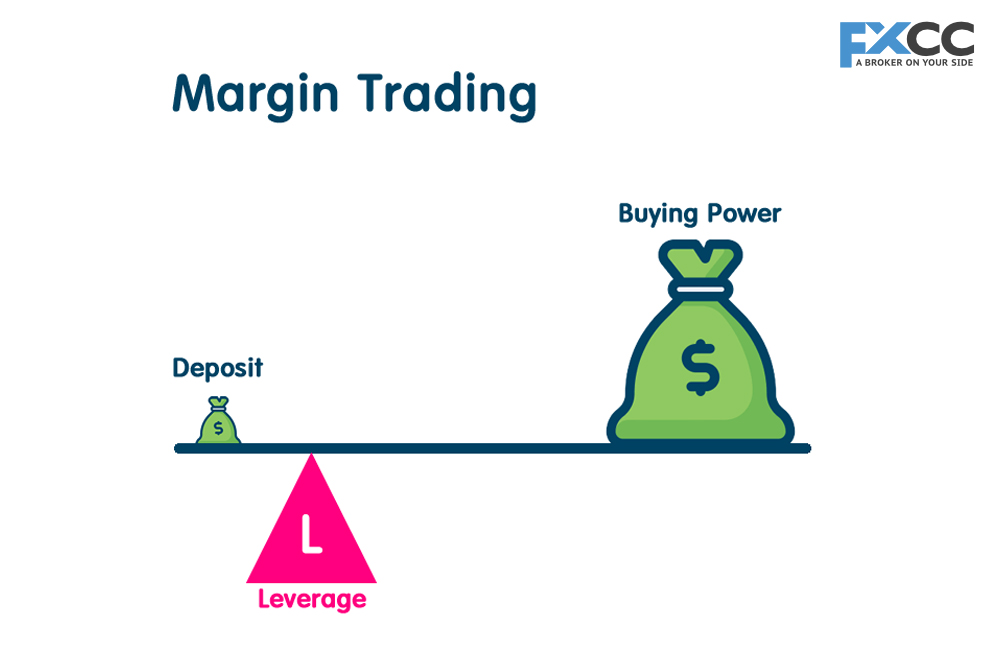

You can find other articles that explain leverage and margins in detail. Still, the practical effect is that your account leverage is what you borrow from your forex broker when you open a position.

Using 1:100 leverage, for example, your broker will lend you $99 for every $1 you put up for trade so that you can trade $100.

It is important because a 1% move with $100 differs from just $1. Putting relatively small amounts into your account allows you to create (and lose) much bigger gains.

Margin calls

Whenever you trade, your broker gives you a “loan,” and that loan doesn’t change if the trade goes your way.

You pay back your “loan” whenever you close a trade and take your profit. However, if the trade goes against you, you start losing. You know that you can pay the amount you’ve put up for the trade, so your forex broker closes your trade to recover the “loaned” funds so you don’t lose more than you can afford to lose.

With a 1:100 leverage, if you spend $1 on a trade, you can take a $100 position if the market moves against you. In other words, the amount you put up for a trade is your “margin.” Your broker will call the trade-off if the market drops by 1%. Otherwise, you would go into negative territory and lose your “margin” of $1. If the market goes down by 0.5%, you have lost $0.50; however, if the market goes down by 1%, you have “lost” $1, and your broker will call the trade-off.

It’s a whole account game.

The forex broker generally gives you some extra allowance for your trades by doing the complement of that principle. Thus, when you enter a trade, the FX broker locks in that amount, and your remaining account balance acts as a margin.

A $2 position with $50 in your account means you can buy $200 on the market at 1:100 leverage. The $2 gets “locked” in by your broker to cover your current trade, and the remaining $48 is your “free margin,” which tells you how much money you have left to trade.

Markets go in your favor if they increase your portfolio equity, so you have more margin available, which we refer to as free margin. If the markets go against you, you have less equity and, therefore, less free margin.

Bottom line

In your trading platform, free margin indicates how much funds are available to open new trades, while margin indicates how much is held for already opened trades. Trade margins influence margin level calculations and when your account reaches margin call. Free margin has no impact on a margin call. In the Personal Area, you can withdraw the free margin that you have available. However, while trades are open, you can’t withdraw the margin that you have held. During any given time, equity is the total margin and free margin.